A special thanks to Matt Joyner and Karol Krucinski, CFA from our partner Fortis Capital Advisors for their initiative and leadership in bringing this thought piece to fruition. Further, Charlie Kolean, President of Strategic Political Management, provided valuable insight into the political process.

Introduction

Investors are turning their gaze towards the 2024 election and its potential range of stock market impacts. We believe this primarily comes down to whether the incoming president’s party and the political makeup of Congress will create or remove political gridlock in Washington D.C. and how investors will come to grapple with that reality.

Political commentary contained in this guide is nonpartisan. Fortis Capital Advisors specifically does not favor any particular candidate or political party and believes introducing political bias leads investors towards unforced errors that detract from their longer term financial goals. The analysis herein attempts to assess political events with a lens towards their potential economic and market impact. The contributors of this guide come from different backgrounds, political traditions, and philosophies – which we felt was important in undertaking this interdisciplinary study of politics and markets. Great effort was made to avoid political biases through the production of this guide.

Since 1926, the overwhelming majority of calendar years (approximately 73%) are years where US stocks, as measured by the S&P 500, are positive. While this seems inexorable, there are trends in stocks’ shorter durations that are notable and exhibit a pattern around the American election cycle. This guide will look and evaluate some of those trends and their potential impact to stock market returns. (1)

The Presidential Election Landscape

The 2024 presidential election is shaping up to be highly contentious. On the Republican side, former President Donald Trump remains a dominant figure within the party. As of now, nothing in the political landscape seems to impede Trump from securing the Republican nomination for another presidential run. His influence within the party is substantial, and his base of support has remained largely intact. Trump faces several legal battles that could potentially become roadblocks to his nomination. These legal issues are diverse, ranging from financial investigations to matters related to his time in office. While the outcomes of these legal fights are uncertain, and not a subject for speculation, they represent the most significant potential obstacle to his candidacy.

On the Democratic side, there are increasing discussions about whether President Joe Biden should seek re-election. Despite this, it appears unlikely that Biden will step aside as the Democratic nominee. One practical consideration is the extensive groundwork that has already been laid for his campaign. Biden’s team has worked to ensure his eligibility to appear on the ballot in every state, a significant logistical and strategic effort.

Replacing Joe Biden as the Democratic nominee for president would be highly unlikely due to the complex and litigious process involved, which would risk tens of millions of dollars in litigation and ballot access across all states. Each state has its own strict regulations for candidate substitution and ballot access, necessitating extensive legal maneuvering and logistical coordination. Moreover, such a move would likely face fierce internal opposition within the Democratic Party, potentially fracturing its unity and alienating key stakeholders. Legal challenges from various quarters, including Biden himself and other primary candidates, would further complicate matters, consuming precious time. Given these formidable obstacles, improbable that the Democratic Party would undertake the risky endeavor of replacing Biden.

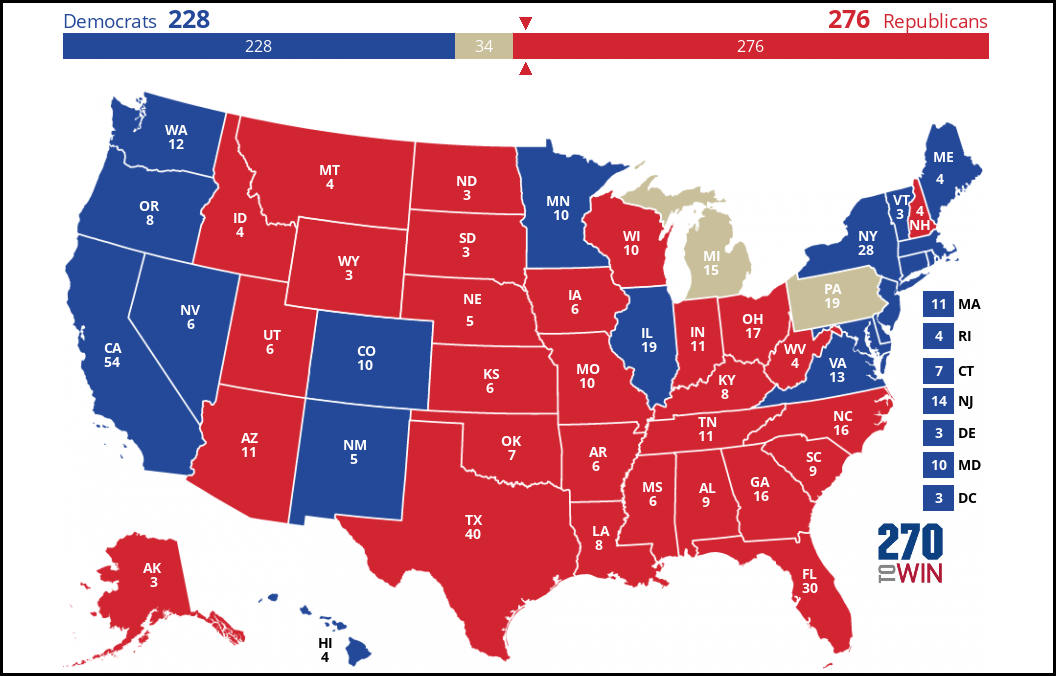

Looking at the legislative landscape, political gridlock seems almost inevitable in 2024–a favorable condition for US equities. This is a typical feature of an election year, where substantial legislative efforts often stall as attention turns towards the campaign trail. The current composition of the Senate further complicates matters. With 48 Republicans, 49 Democrats, and three independents (Angus King, Bernie Sanders, and Kyrsten Sinema, all of whom have historically aligned with Democrats), the balance is incredibly delicate. This composition makes it challenging to pass significant legislation, as nearly every vote hinges on near-unanimous party support or cross-party negotiations.

In the House of Representatives, the situation is similarly divided. The Republicans hold a slim majority with 219 seats, while the Democrats have 213. There are three vacant seats with projections suggesting that two will likely be won by Republicans and one by a Democrat. This distribution further underscores the likelihood of legislative gridlock. With such narrow margins, both parties will be focused on protecting their interests and preparing for the upcoming elections, rather than engaging in bipartisan lawmaking.

Bottom-Up Election Analysis

Our analysis of the 2024 presidential election takes a look at the party control of state legislatures. This captures more nuanced political undercurrents and changes happening within the states themselves. In isolation, this would mean a win for Donald Trump; however, owing to the partisan divide in the country, and a decent amount of time remaining before the election, we do not believe a Donald Trump presidency is a foregone conclusion.

Source: National Conference of State Legislatures, 270toWin

Presidential Term Cycles and Stocks

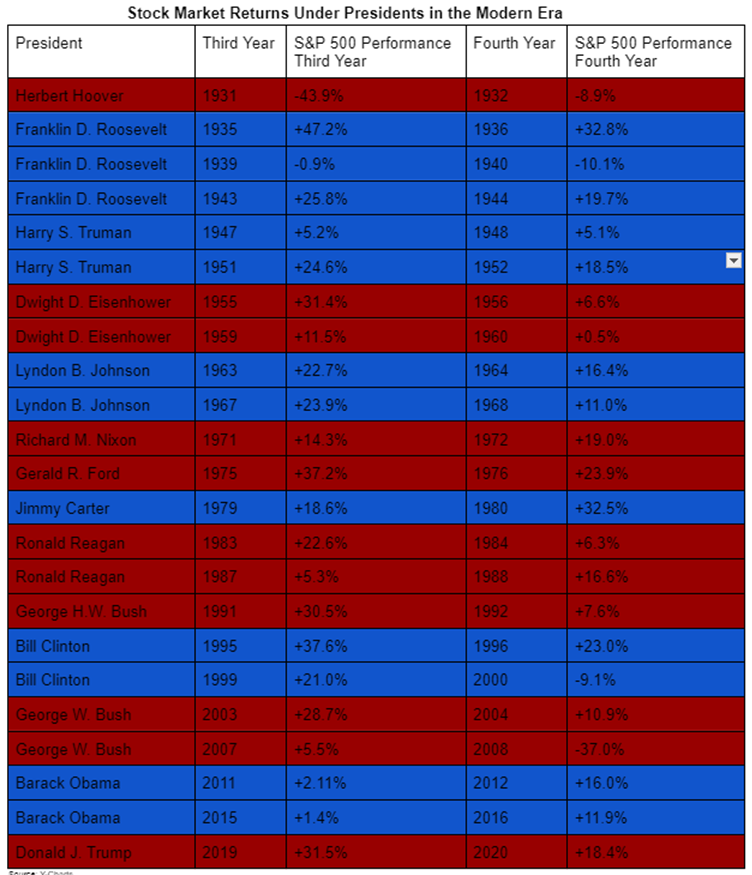

Presidential power is almost always overstated in American media culture. Presidents cannot act unilaterally without Congress, and even Executive Orders can be nullified by congressional action and overturned by successive presidents. The system of checks and balances as developed by the framers of the Constitution works as designed. Presidents, upon inauguration, have more political capital than at any point during their presidency. The first 100 days is incredibly important for a president taking office to be able to set and enact the agenda they campaigned on. This political capital tends to wane over time creating an environment of falling political uncertainty that markets appreciate. This is reflected in the third and fourth years of a president’s term being overwhelmingly positive for stocks as measured by the S&P 500. Stock market returns were positive 91% of presidents’ third years, and 82% of presidents’ fourth years.

Source: YCharts

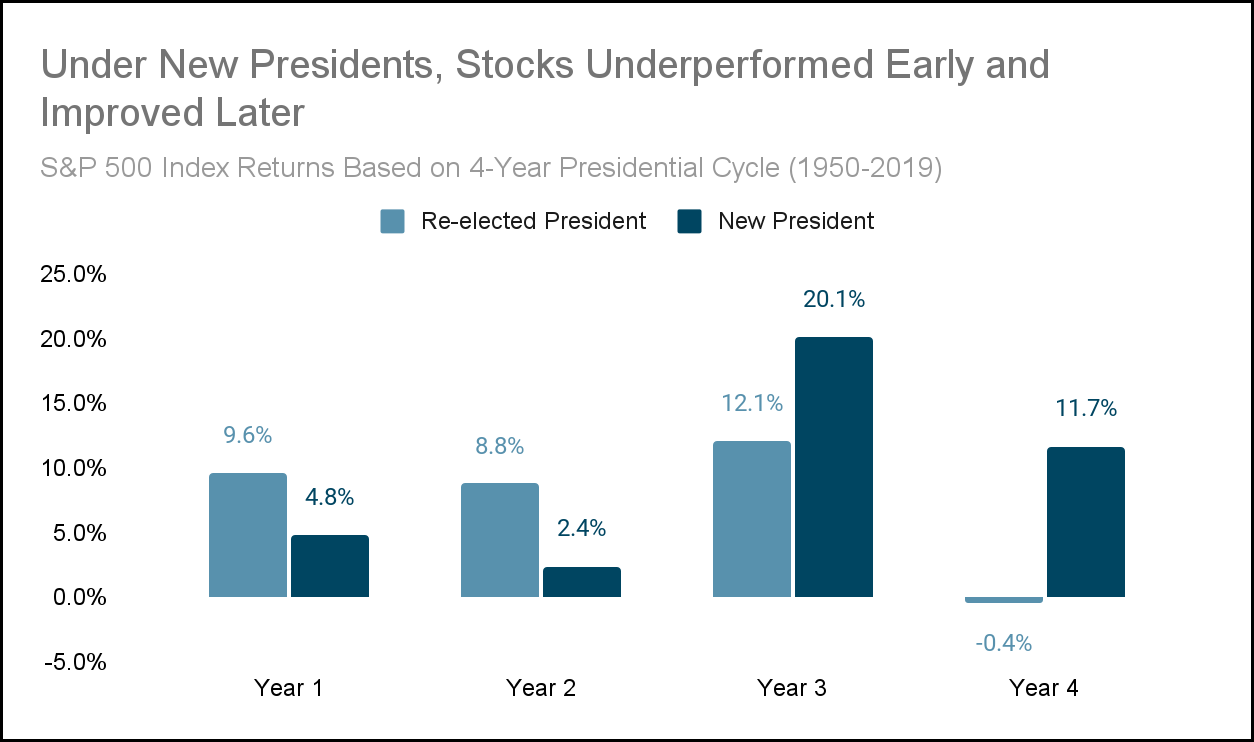

Stocks Favor Falling Political Uncertainty

There is additional research to show how the S&P 500 typically underperforms in the early years of a president’s term and then as political capital fades it creates a backdrop for stocks to do well.

Source: LPL Research, Factset 11/05/20 (1950 - 2019)

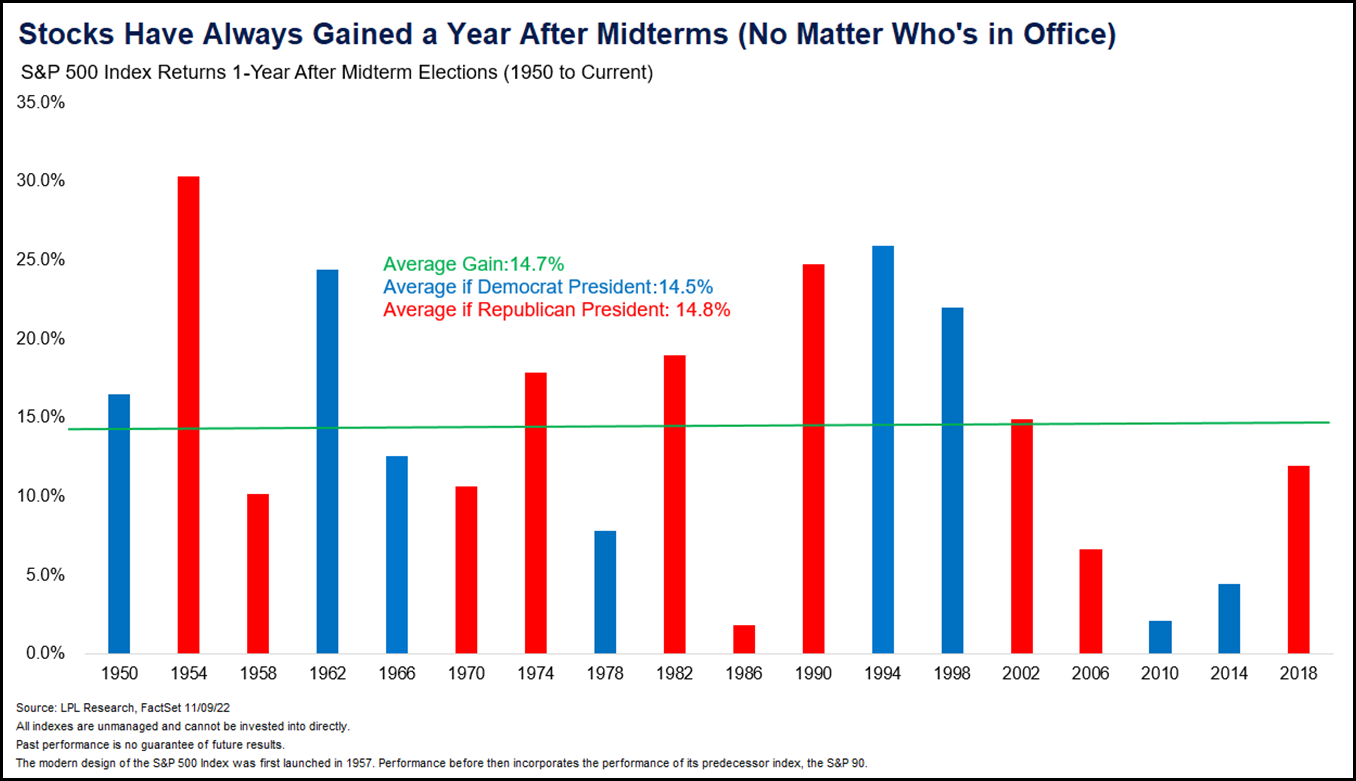

Gridlock is Good for Stocks

Markets most care about the balance of power within the government. It’s more common than not that when a President takes office their political party suffers in the midterms. This happens because, as is often said in political consulting, “People will walk 10 miles in a blizzard to vote when their party is out of power, but won’t cross the street on a nice day to vote for their candidate when their party is in power.” This creates a condition where gridlock persists and creates an environment where stocks historically do well.

Which Political Party is Best for Stocks?

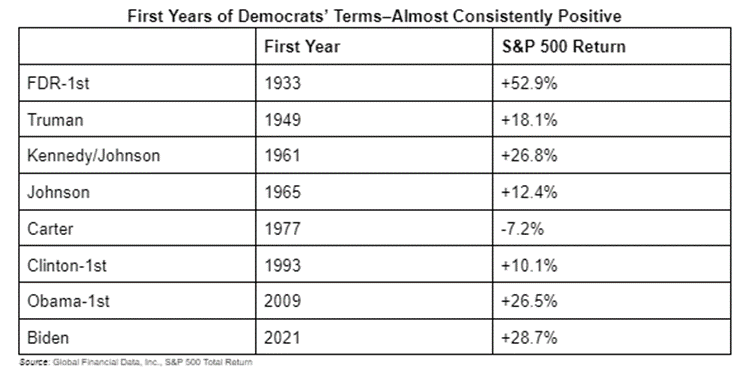

It is not uncommon for investors to introduce political bias into their investing strategy. If you’re a Republican you tend to see things as being better when they are in charge, and vice versa for Democrats. By that same logic, many think their political party will always be better for stocks and the economy. In modern history, US stocks as measured by the S&P 500 have historically performed better under Democratic administrations. Investors are largely conservative and tend to vote in favor of Republican party policies which are traditionally low tax and pro-business. Conversely, Democrats typically support more involvement by the government which generally involves higher taxation and more regulation on business. This being the case, why would stocks perform as well in Democrats’ inaugural years?

This tends to be the case because incoming Democratic presidents campaign on changes to the tax code and regulatory environment that many investors perceive as being not pro-market or pro-economy. Stocks tend to perform poorly in the election year when a Democrat is elected to office as investors begin to worry about political headwinds to the economy. In the inaugural year when a Democrat takes office, you tend to see the same candidate moderate or have their campaign promises stymied in congressional gridlock.

We see the inverse happen when Republicans take office. Expectations for a Republican to slash taxes and red tape are reflected in positive election year returns for stocks where a Republican will be taking office. In the inaugural year you see stocks falter as it becomes more evident a Republican president won’t be able to enact all of the pro-market and pro- economy initiatives that they campaigned on.

What Political Happenings Could Roil Stocks?

Banning Stock Buybacks

Stocks move on the difference between expectations and reality. Stocks therefore undergo more volatility when there are big surprises. We saw this in the notable case of Donald Trump’s surprise election to the presidency in 2016. Stocks can also respond negatively to legislation or regulatory changes, especially ones that are both widely underreported by media and widely approved of by both sides of the political aisle. The wide approval of banning or using government policy to stem the tide and tax stock buybacks and repurchases, in our opinion, represents a potentially large regulatory headwind for stocks. This has become something of a political football with rhetoric from Democrats on this issue being omnipresent for decades. However, Republicans’ anti-business turn that began in 2016 has brought enough Republicans to align with Democrats on this issue. Marco Rubio in 2018 penned an op-ed in The Atlantic defending a proposal to tax share repurchases, not dissimilar to President Biden’s 2023 State of the Union address in which he called for quadrupling the excise tax on stock buybacks.

Warren Buffett in his 2023 annual letter to Berkshire Hathaway shareholders wrote, “Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect. Imagine, if you will, three fully-informed shareholders of a local auto dealership, one of whom manages the business. Imagine, further, that one of the passive owners wishes to sell his interest back to the company at a price attractive to the two continuing shareholders. When completed, has this transaction harmed anyone? Is the manager somehow favored over the continuing passive owners? Has the public been hurt? When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver- tongued demagogue (characters that are not mutually exclusive).”

We agree with Mr. Buffett.

Tariffs Under a Trump Presidency

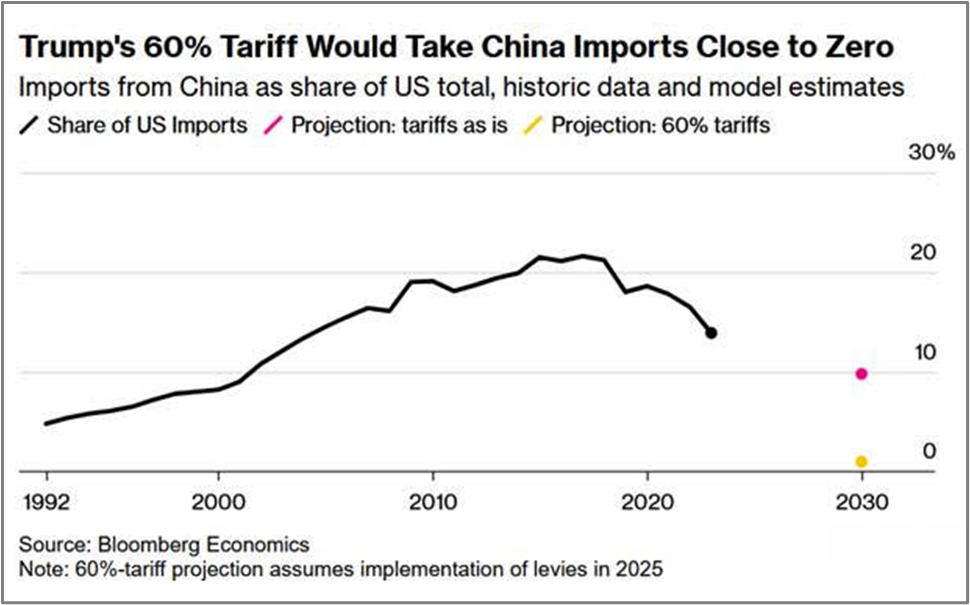

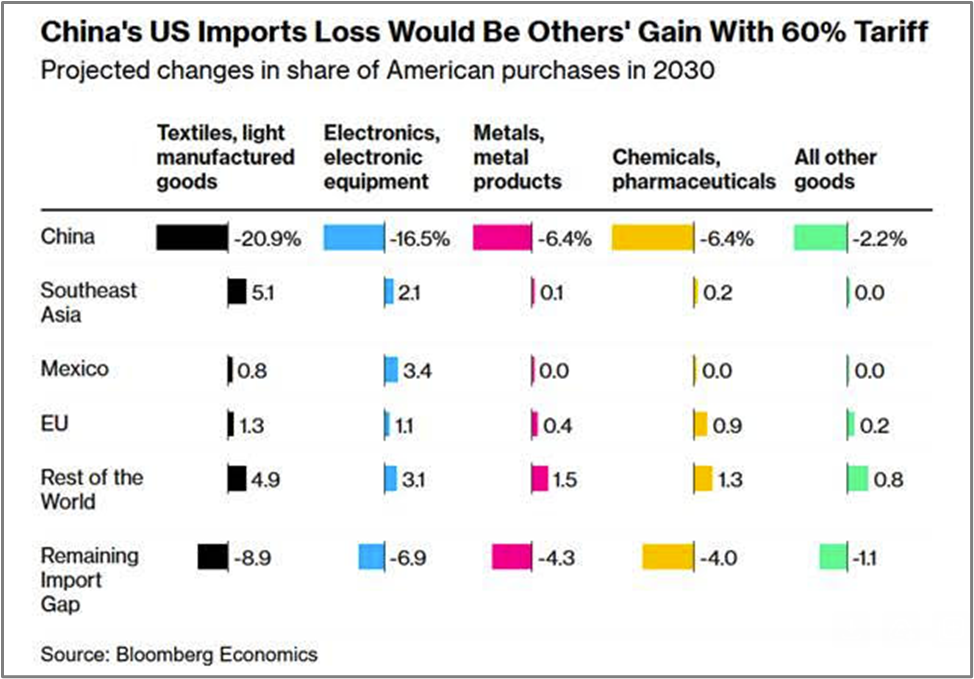

If tariffs were to be implemented under a potential Trump presidency, and as he has campaigned on, it could significantly impact the stock market reminiscent of the stock market correction in late 2018. The uncertainty surrounding trade policies could lead to volatility as investors try to gauge the potential consequences for various industries.

Moreover, retaliatory measures from trading partners could exacerbate the situation, further unsettling investors and causing fluctuations in stock prices. Investors may react negatively to the prospect of tariffs, fearing reduced international trade and slower economic growth. Companies that heavily rely on imports or exports could face challenges navigating the new trade landscape, leading to decreased earnings and lower stock valuations. Additionally, the uncertainty generated by shifting trade policies could dampen investor confidence and prompt them to reallocate their portfolios, exacerbating market volatility.

Media headlines around retaliatory tariffs will hyper focus on the negatives, but we feel that countries can bypass tariffs with relative ease. With a global supply chain, companies can utilize third party countries to ship goods through to evade tariffs.

Conclusion

While it is impossible to predict the precise outcome and its direct consequences, history has shown that elections can create short-term market volatility as investors react to policy changes and uncertainties. However, it is crucial to maintain a long-term perspective and focus on the underlying fundamentals of the economy and individual companies. Regardless of the election outcome, the stock market has demonstrated resilience and the ability to adapt to changing political environments. Investors should remain vigilant, well-informed, and proactive in managing their portfolios. Diversification, asset allocation, and disciplined investment strategies are key components of weathering any market fluctuations.

It is worth noting that market movements during election periods are influenced by a multitude of factors beyond the election itself, including global economic conditions, technological advancements, and geopolitical events. Therefore, a comprehensive approach to investment decisions should consider a broader range of factors rather than solely relying on election-related outcomes. As always, seeking the advice of a qualified financial professional is crucial when navigating the complexities of the stock market and investment landscape. They can provide tailored guidance based on your unique financial goals, risk tolerance, and time horizon.

(1) https://insight.factset.com/sp-500-companies-reporting-positive-eps-surprises-for-q1-see-below-average-price-increases

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments