The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

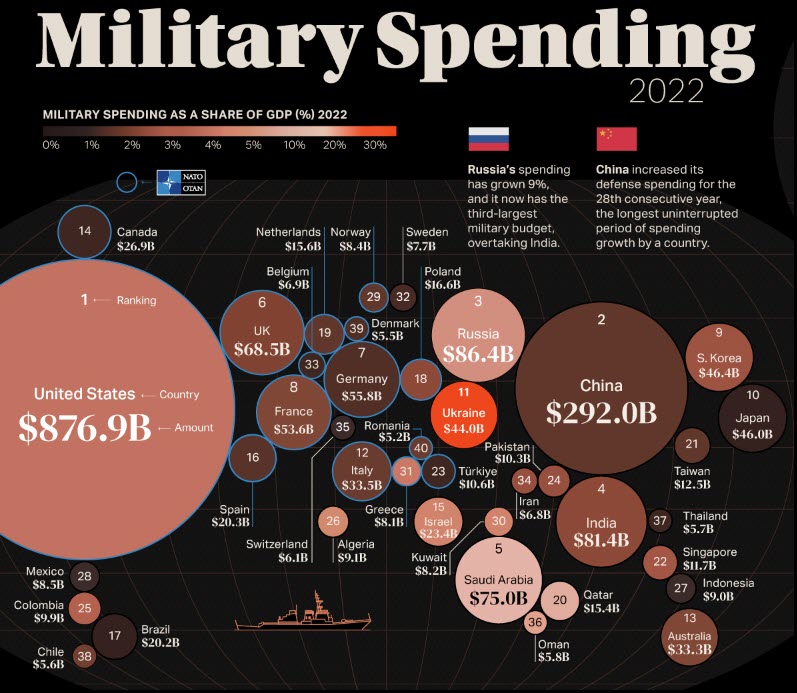

Source: SIPRI Military Database, Visual Capitalist

Source: SIPRI Military Database, Visual Capitalist

Geopolitical Risk – It Was Only a Matter of Time, Unfortunately

- What we know: Iran executed an extensive, albeit hardly secretive, drone and missile attack on Israel in retaliation for Israel’s recent strike on Iran’s consulate in Syria

- US markets caught wind of the pending attack on Friday and risk off activity ensued…

- According to Israel, 99% of the incoming munitions were defeated by the Iron Dome (US aided) as well as from allies in the region, namely Jordan and Saudi Arabia

- Importantly, this represents a different tact on Middle East matters as Iran has used proxies in the past to attack Israel while these attacks were direct from Iran

- Where this goes next is TBD…Iran has said “the matter can be deemed concluded”…Israel has said an Iranian attack may be “imminent”…while the US has told Israel they would prefer to “not take place in a counter strike” against Iran…

- The conflict likely remains open-ended while the US has become more directly involved in the Middle East through the use of Navy anti-missile systems

- Neither oil prices nor US Treasury securities, both risk off assets, spiked higher over Monday and Tuesday and stock prices were largely mixed suggesting investors are not panicking over events

- We should likely expect the US$ to remain firm as investors seek safe haven assets and concerns over US deficit and debt financing concerns subside for the time being

- Investors should remember that the market tends to see through these risks and focuses on direct economic impacts

- Things to consider…will Iran take greater measures to stop the flow of oil through the Straits of Hormuz? We think not and oil’s retrace of its last Friday moves suggests the market agrees with us…

- Why? China now receives much of Iran’s oil production and lack of transport will cut off Iran’s key revenue source and increase pressure on an Iranian ally and tenuous Chinese economy

- Will Israel heed the US call for restraint or opt to move forward with an Iranian strike and potentially risk endangering the US relationship? We believe the former…

- We think it makes sense for Israel to retaliate but in such a way that the situation is de-escalated…most likely fixed military or infrastructure assets far from civilian presence or a cyber attack of some sort

- Might this prompt Congress to act with greater speed in sending additional military resources to both Israel and Ukraine? Yes, and will help defense related stocks over the medium term

- Will we see a return to large cap growth outperformance as investors flee to companies with secular growth models…entirely possible

- Commodities, especially oil, will likely remain well bid with many are already in physically tight positions that have supported prices

- The Biden administration has taken its sweet time filling the Strategic Petroleum Reserve thus it is not in the U.S. interest to spike oil prices higher

- Perhaps most importantly, will this impact the US consumer behavior? The retail sales report was strong on Monday but breadth was mixed…unlikely this hamstrings US consumption until such time that escalation takes a significant step higher and threatens far greater US involvement

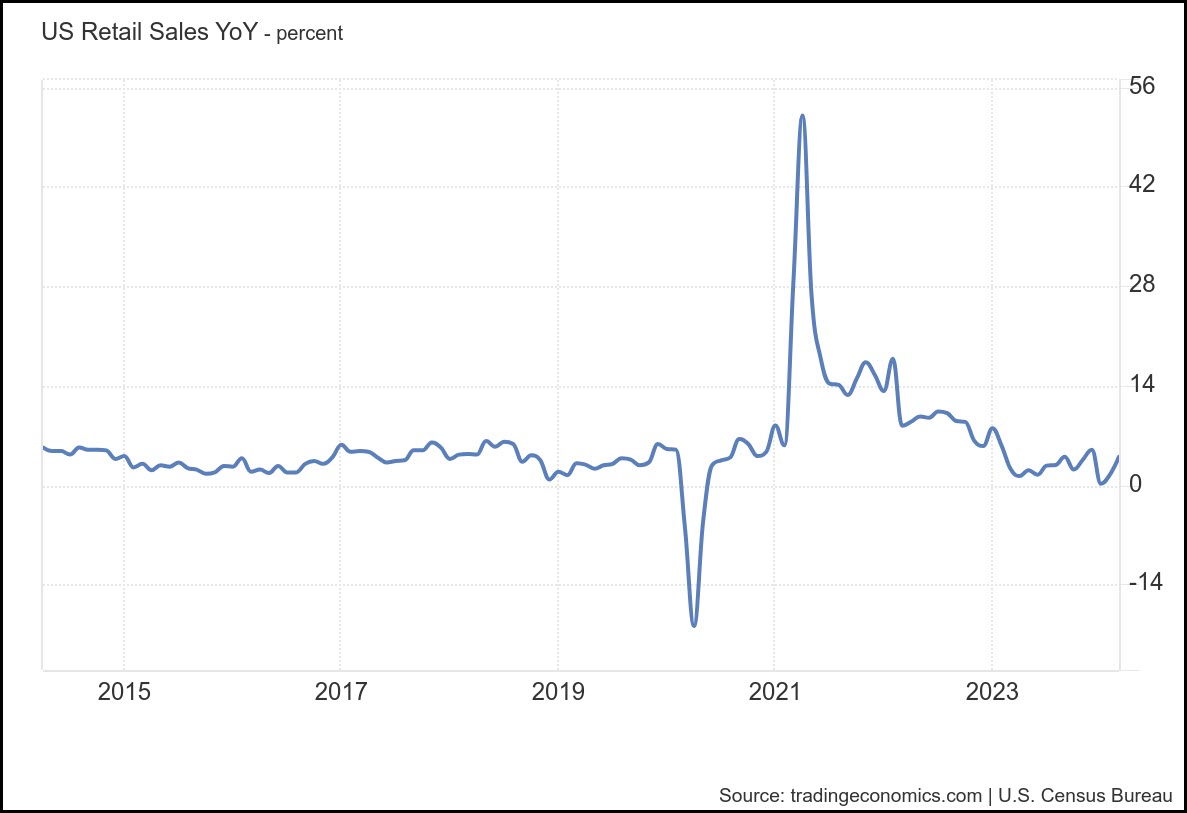

March Retail Sales – The Consumer Keeps on Chugging Along led by E-Commerce

- Advance estimates for U.S. retail and food services increased by .7% m/m and 4% y/y in the month of March ’24, above consensus of .4% m/m

- M/M results have been choppy with February revised up to a .9% m/m increase after January reported a (.9%) decrease…the 3-month period reported a 2.8% increase

- The March increase was driven by a strong result in e-commerce which showed a 2.7% m/m increase, the largest increase since Jan ’22..and accelerating from a (.8%) and .2% (revised) m/m prints in January and February, respectively

- The average m/m e-commerce increase going back to January 2019 is 1.23%…this was an outsized e-commerce print…

- Also contributing to the gains were a 2.1% m/m increase in gasoline stations and miscellaneous store retailers

- Interestingly, there were 5 categories that reported negative m/m comparisons (Motor vehicle/parts, furniture, electronics, clothing, and sporting goods) relative to only one category (sporting goods) in February…thus we believe that the breadth of the report was fairly weak

- However, given that the headline number rose faster than the .3% consensus, we would expect to see the Atlanta Fed GDP NOW estimates increase from a current 2.4% level for 1Q24

- Bottom line, it will be interesting to see if trends in e-commerce remain as robust as reported in March…we have no explanation for why they accelerated so meaningfully

- That said, this report continues to throw caution on the expectation of a consumer slowdown which is being sustained by strong employment trends

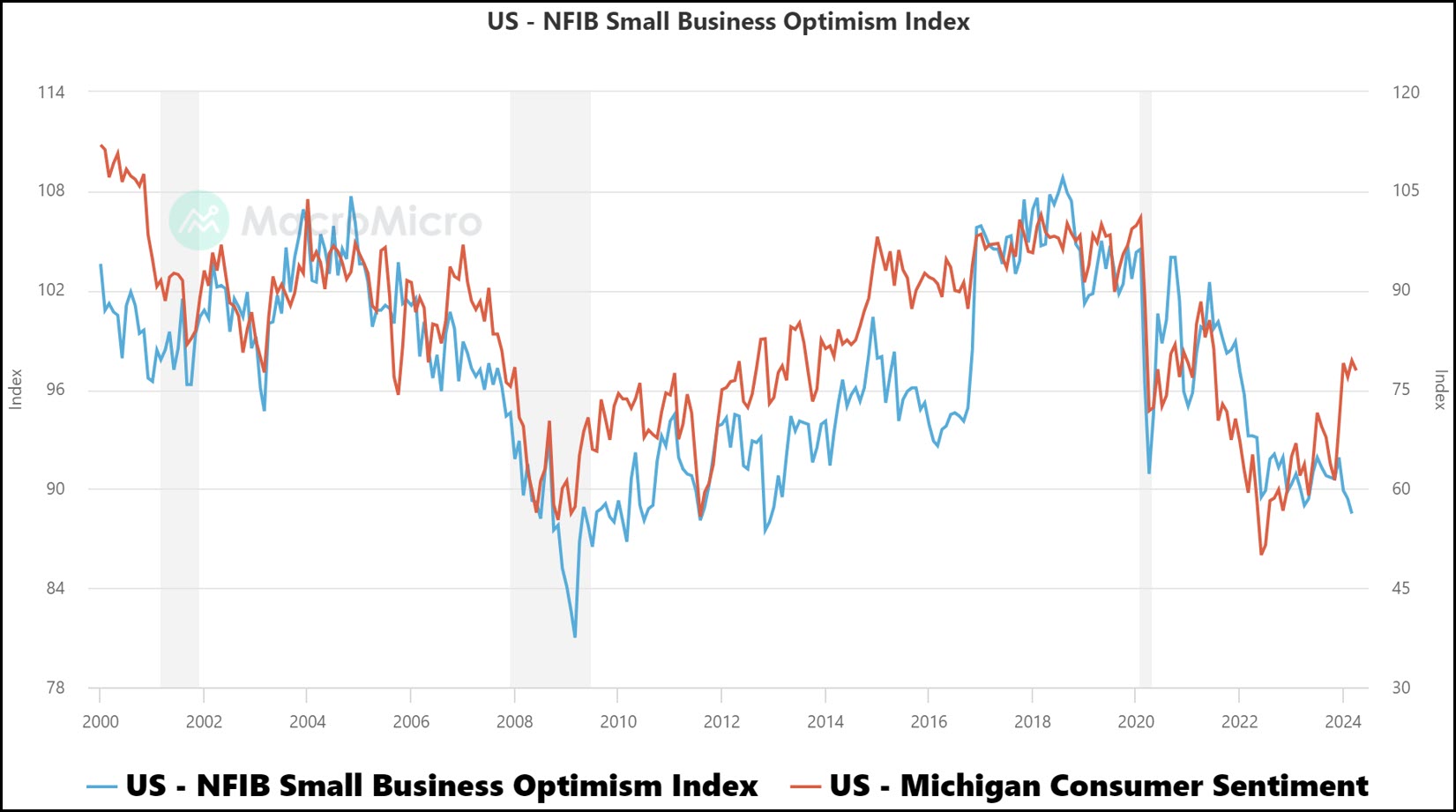

Source: MacroMicro, TPCM

Source: MacroMicro, TPCM

NFIB Small Business Optimism at 2012 Lows…More Inflation Impact

- We were struck by the above headline as we would have thought that a bull market since October, hopes for declining interest rates and rising consumer confidence would have increased small business owner optimism

- Alas, that is not the case and small business owner optimism has now spent 27 consecutive months below the 50-year average of 98

- The NFIB has 325K member with the average member having 10 employees and $500K in annual revenue (NFIB)

- The biggest change in the index components in March was “expected real sales higher” which decreased by 8 p.p., followed by a 2 p.p. decline in “expected credit conditions”

- Perhaps no surprise, 25% of owners reported that inflation, reflected in both higher input and labor costs, was their single most important problem while 43%, up 6 p.p., reported having raised their average prices.

- Inflation as a culprit for lower optimism can be seen fairly clearly by the chart above as the decrease in owner optimism starts in late 2021 and it has not recovered…this timing coincides with the increase in the Consumer Price Index

- Labor conditions remained tight with 37% reporting that they had openings they could not fill in the current period, flat m/m, but the lowest reading since January, 2021

- Perhaps as a consequence of lower expected sales and higher costs, owners plans to hire in the future declined to levels last seen in May, 2020

- The net effect of the above is that Small Business earnings are down almost 30% from 2018 peak levels (page 9)…yikes!

- Net net, things are very difficult for small business owners…with hopes for rate cuts being eliminated or pushed out there appears to be little relief for small business owners

- Bigger is better…much like the stock market where the larger capitalized companies are doing better than the small cap market, evidenced by IWM, which continues to be under pressure

- Does this move the needle for the Fed and potential rate cuts? Unlikely, but it may be just one small indicator of why Biden’s ratings approval is so low…

IMPORTANT DISCLOSURES

Investment advice is offered through Fortis Capital Advisors, LLC, 7301 Mission Road, Suite 326, Prairie Village, KS 66208.

While reasonable efforts were used to obtain information from sources believed to be reliable, Fortis Capital Advisors, LLC makes no representation that the information or opinions contained in this website are accurate, reliable, or complete. All information and opinions contained in this material are subject to change without notice.

This material contains external links to third party content (which is content hosted on websites not affiliated with Fortis Capital Advisors, LLC). Fortis Capital Advisors, LLC does not endorse or accept responsibility for the content, or the use of any third party website. All such information and access is provided solely for convenience purposes only.

Recent Comments