The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

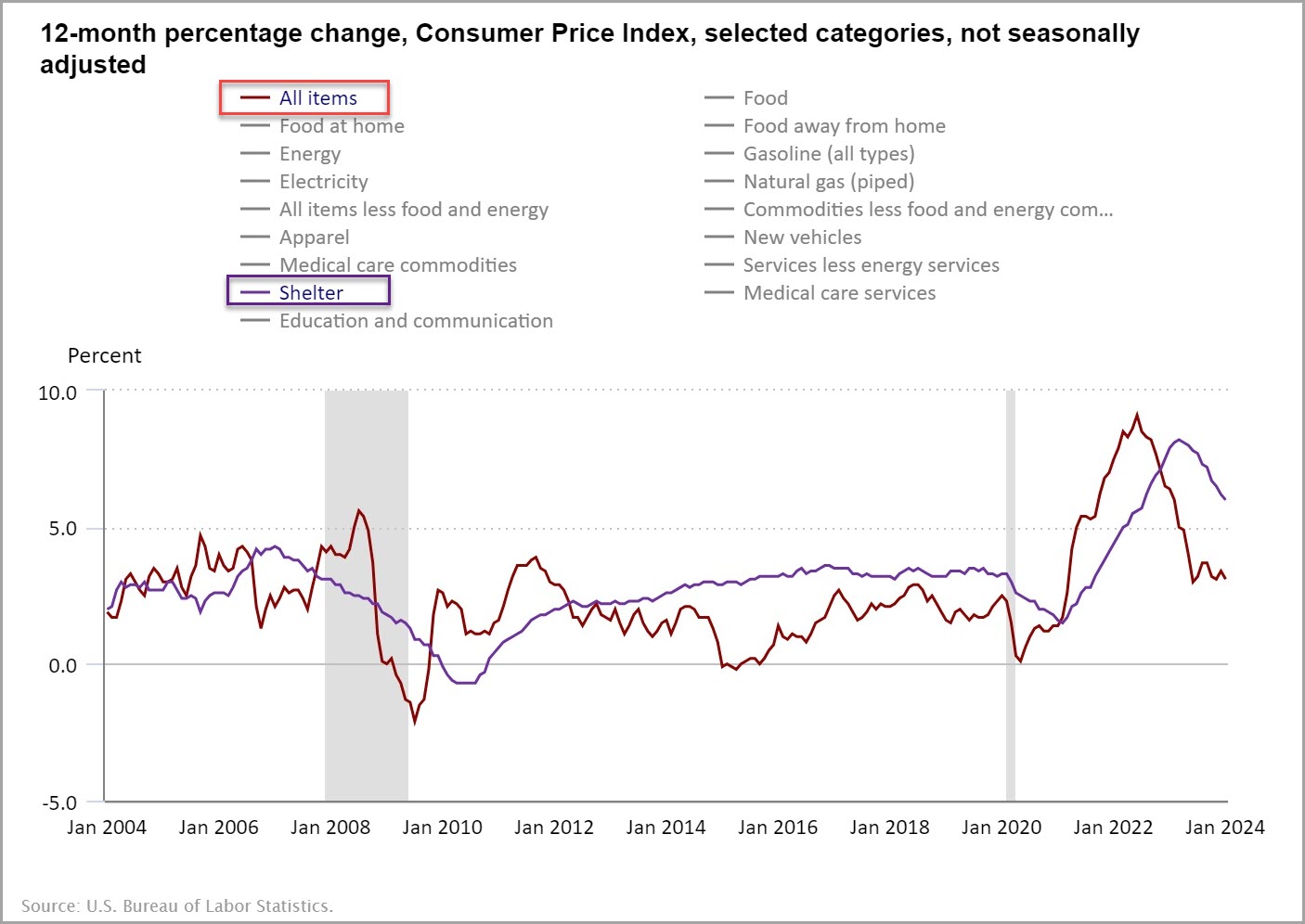

Inflation Surges…Just Kidding, We Are Still on Track for Moderating CPI and PCE Prints

- A full week of inflation data that has the talking heads, and somewhat less so the bond market, worried about “sticky” inflation

- 10-year yields increased ~ 20 bps on the week, ending at 4.30%, which compares to late December lows of 3.80%…but still well below the 5% level achieved in late October ’23 (YCharts)

- Y/Y CPI core print of 3.9% was unchanged from prior month levels (December), albeit above forecasts of 3.7%…this represents a 2.5 year low and continued improvement (see above chart)

- Shelter continues to be the driver to the CPI, clocking in at up 6% y/y and accounting for 2/3 of the y/y increase…we continue to expect this figure to decline in the coming months

- Why? National single family rent indices continue to post far lower increases…for instance, Corelogic notes a 2.7% y/y increase in November – we will see more recent data this week but don’t expect a change in the recent trajectory

- We believe the lag effect of current rental rates (including Owners Equivalent Rents) “amortizing” into the CPI figure can take from 12 -18 months…as does an April 2023 study from the Federal Reserve of Richmond

- We would also point out that the CPI is far more weighted to rental and OER weightings than the Fed’s preferred PCE…Housing Services in the PCE is ~ 15% vs. ~33% in the CPI

- From our vantage point, there is little change in continued downward trajectory for inflation…we expect gradual declines with the possibility for surprise as m/m figures of .5% in February and April ’23 should provide relatively easy compares…

- Recent median household inflation expectations for one and five years remained steady at 2.5% and 3%, respectively, while the 3 year median expectation declined to 2.4% compared to 2.6% according to the Federal Reserve Bank of New York

- Additionally, we believe that wage growth will continue to abate which should ease inflation in the services component of both the CPI and PCE…the recent Employment Cost Index (Jan 31 print) showed a .9% increase on a 3 month basis and 4.1% increase y/y…

- Finally, M2 money supply and the Fed’s balance sheet continue to slowly contract…if we believe that inflation is too much money chasing too few goods then the inflation decline over the past year should not be a surprise despite strong labor markets

- We still expect a few (two or three) rate cuts of 25bps starting mid-year which should thread the needle of allowing the Fed to lower real interest rates while stopping short of having the Fed becoming too aggressive in an election year

- Where could we be wrong? Certainly with all the geopolitical turmoil in the world we could see continued elevated freight costs that can seep into goods prices, the potential for food supply issues as well as oil supply crises…these thoughts are not entirely novel but do need to be monitored

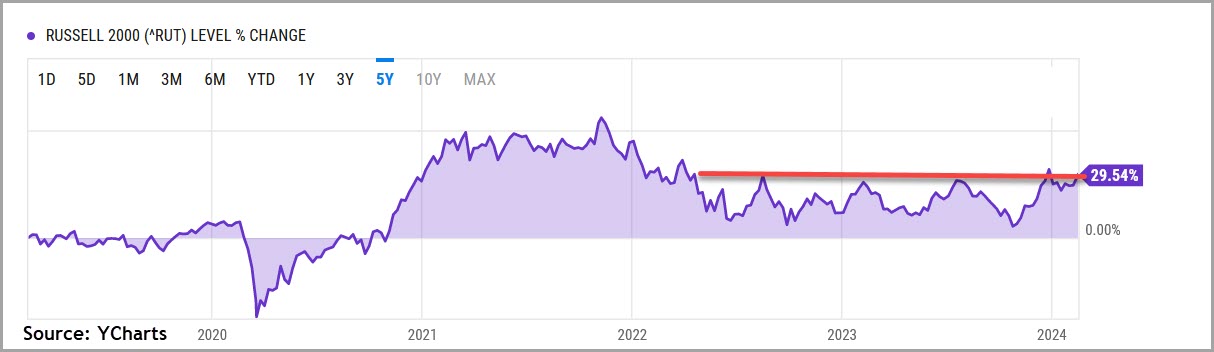

Small Caps Trying Their Best to Break Out…will the 5th Time Be The Charm?

- It has been a wonderful few months in the equity markets with the SPX advancing a bit more than 20% since the October ’23 lows…fueled by the end of “higher for longer” rates and the Magnificent Seven (or name your number…)

- However, the most recent Powell presser (1/31) effectively took March rate cuts off the table (“not my base case”) as did recent economic data, specifically the CPI print mid last week

- We continue to believe the equities will broaden out…small caps (Russell 2000, IWM) have posted a 24% return from the October ’23 lows…could it finally be time for small caps to wake up and outperform large caps over a sustained period of time?

- Over time, multiple decades to be specific, small and mid caps have achieved returns in excess of large caps – albeit with greater volatility of returns. Thus, one needs to be committed to the space over a long period of time to achieve superior returns

- We think now is an opportune time to add to small and mid cap exposure…for starters, valuation metrics on small caps are not demanding on an absolute or relative basis. At 14-15x 2024 eps estimates, small caps are trading at a 20% discount (page 2) to longer term p/e valuation and are near long term lows relative to the SPX.

- Small caps have historically performed well following recessionary periods – we are not forecasting a recession. However, we do believe that interest rate cuts are a big factor in small cap performance and we do expect the Fed to begin cuts mid year.

- As can be seen on page 3, small caps have historically outperformed large caps following a recession…which have always included rate cuts. We believe we are entering a strong environment for small caps to outperform.

- Perhaps one reason small caps have struggled is the lack of earnings growth over the past 18 months relative to large cap. As seen on page 4, small and mid-cap earnings have stalled after the post pandemic bounce.

- Importantly, earnings growth is expected to pick up in the back half of the year and approach large cap levels in 3Q and 4Q24. We believe this could be the catalyst to spark a small cap rally.

- Finally, on a technical basis, small caps (RUT) have been in a trading range for the past 18 months…as the saying goes, “the longer the base, the higher in space” which we believe will be the case for small and mid caps through 2024 and 2025

Biden vs. Trump – Why Neither May Be Good For The Economy

- Regardless of your political bent, it is worth pondering what policies will actually be enacted in the event of either a Biden or Trump presidential victory…we will leave the question of whether Biden will in fact be the Democratic candidate for a later date

- For the time being, we think there is real potential that both will pursue misguided trade policies that will slow economic growth via creation of economic inefficiencies

- In fact our economic consultant, Victor Canto, has argued that Trump and Biden are effectively two sides of the same coin, with both eschewing globalist policy to promote national interests

- We have recently listened to Trump promoting 60% tariffs on Chinese goods, probably more “tough talk” than reality, but it is a good lens into his economic thinking

- For Trump, as we heard in his first term, he believes the presence of a trade deficit is the U.S. being cheated by its trading partners and thus wants to exact a “cost” to doing business with the U.S.

- Do these tariffs benefit the U.S. economy as a whole? We sincerely doubt it does though we do concede that certain industries will be most certainly be better off although largely at the expense of other industries

- On the other hand, Biden wants to protect labor by erecting barriers around competition to certain industries and/or funneling funds to preferred sectors – The Chips Act, Green New Deal, etc.

- It is our contention that this level of “dirigiste” in the economy skews growth to favored industries of the moment but long term typically culminates in a misallocation of capital

- We hope to hear more from both candidates but, by and large, we have had four years of Trump policy and three years of Biden – there are unlikely to be many surprises moving forward

- Importantly, pandemic capital flows have served to augment the consumer balance sheet as have ongoing strong labor markets… we hope that the consumer can continue to offset what we view as misguided industrial policy from both candidates

- To be fair, Trump did enact personal and corporate income tax cuts and we are hopeful that he will be be able to extend them past their expiration date at the end of ’25 – which could be a function of House and Senate control.

- As for Biden, increased regulations that direct investment choices and “hidden” tax hikes to pay for government initiatives will likely continue in a second term…neither are optimal

- Neither candidate has wanted to take on the tough task of entitlements and both have significantly grown the budget deficit and national debt during their time in office…we expect more of the same going forward

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Fortis Capital Advisors, 500 Damonte Ranch Parkway, Building 700, Unit 700, Reno, NV 89521, (913) 222-8862.

Hello! I’ve been reading your web site for a while now and finally got the courage to go ahead and

give you a shout out from Kingwood Texas! Just wanted to say keep up the good work!

Hi David,

Thanks for the note…we have been in a transition so Timber Log’s have been a bit off schedule but hope to get back to a more regular publishing schedule soon. All the best, Pat