The following is an edited excerpt of a longer article by Victor Canto, PhD. Please contact us for a copy of the entire article.

According to the US Commerce Department, the US economy grew at a 5.2% annual rate during 3Q23. The Biden administration did not waste any time crediting Bidenomics for the faster-than-expected expansion rate. Below is part of the White House statement.

“I always say it is a mistake to bet against the American people, and just today we learned the economy grew 4.9% in the third quarter. I never believed we would need a recession to bring inflation down – and today we saw again that the American economy continues to grow even as inflation has come down. It is a testament to the resilience of American consumers and American workers, supported by Bidenomics—my plan to grow the economy by growing the middle class.” President Biden

The above statement raises several questions, the first one being whether the economy is doing as well as the President claims and, if so, is the economic expansion sustainable? If not, could there be an alternative explanation and forecast?

IS BIDENOMICS THE SOLUTION?

Bidenomics is best described as an application of a textbook Keynesian framework. The President seems to believe that through higher spending and taxes it can manage the economy’s aggregate demand thus resulting in a higher level of output and employment. The justification for the taxes assumes that substitution effects are small. As a result, Bidenomics assumes that tax rate cuts will have no meaningful supply side response on the economy. Given this assumption, a tax rate cut is nothing more than a redistribution to the rich, i.e., the taxpayers. A tax rate increase is then interpreted as an increase in funds available to the government to finance Bidenomics’s policy objectives. Under these conditions, the administration will always push for tax rate increases.

Elsewhere we have argued that from a static point of view, income redistribution is a zero-sum game. One group’s gain is another group’s loss. Therefore, the only way income redistribution results in an increase in aggregate demand is if in fact the marginal propensity to consume of the recipients exceeds that of the higher income taxpayers. This is a testable and quite likely a refutable assumption. In any event, even if there is no net increase in aggregate demand, the income redistribution policy fits perfectly into the administration social justice programs.

The administration’s dirigisme leads naturally to an industrial policy where the administration is directly guiding the economy as to what to produce, how to do so and whom should do so. Some of these examples include the green agenda and the administrations’ semiconductor policy. The administration is clear in stating and believing that climate change is an existential threat. It also believes that the private sector and the markets will not steer the economy to address the issue fast enough. In effect, it is implicitly assuming that there is an externality and the government feels compelled to act.

All of this points to an increase in government spending. If the higher tax rates do not raise enough revenues to finance the spending increase the result is large budget deficits which have to be financed either by printing money or increasing the public debt. We have already tried the money printing bit and it did not work out well. If the Biden administration is worried about the size of the public debt, it may look for other ways to implement its agenda. One way to reduce the deficit and still pursue the objective of solving the problems that pose an existential crisis is to enact government mandates and regulations in order to cajole the economy into implementing its preferred agenda.

In short, in our opinion, Bidenomics means an increase in government spending and regulations, with the government choosing winners and losers and directing the economy. All of this suggests that Bidenomics leads to an increased degree of government intervention and dirigisme.

OBJECTIONS TO BIDENOMICS

Opponents of Bidenomics argue that people do respond to incentives, that the substitution effects are larger than the Biden administration assumes, and that the supply side responses may be significant. Consider the migration from blue to red states as an exercise in the arbitrage of differential state tax rates. Or, workers choosing to stay home when social safety net benefits received during the pandemic are in excess of compensation for returning to work. The bottom line is that incentives do matter and marginal tax rates and means testing of social safety net benefits affect economic activity.

We also argue that Bidenomics income redistribution does not increase aggregate demand. While the beneficiaries are better off and as a result they increase their demand, the people paying for these benefits are worse off and they reduce their aggregate demand. When both groups are added together there is no aggregate demand effect. All we can say is that one group is made better off at the expense of another. Historically, the government has not been very good at picking winners and losers – think about the current state of the EV market and the eastern seaboard wind farms that are now demanding bigger subsidies.

So who is right, the government or the market? Even if the government is correct in identifying and eliminating the externality, the market is best at determining the appropriate technology and the optimal pace of transitioning to the new economy. A government mandated speed of adjustment that differs from the market solution is suboptimal and will make the economy worse off. Government mandated implementation, i.e., choosing winners and losers, is a recipe for failure.

GOING FORWARD INTO 2024

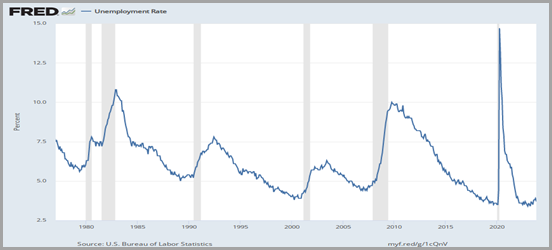

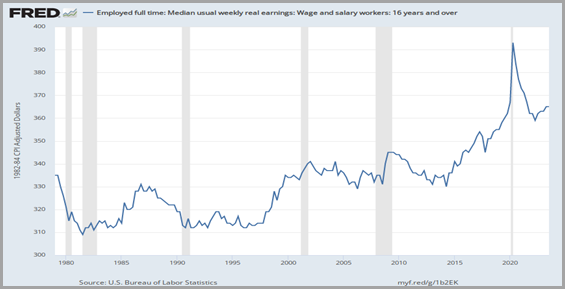

Not surprisingly, the Biden administration is doubling down on Bidenomics. Among the policy’s successes, the President touts the administration’s increased spending on income redistribution. He argues that this component of his policies is reducing poverty and helping to grow the economy by growing the middle class. Further statements tout the strongest U.S. economic recovery ever, an unemployment rate that has been below 4% for 20 months in a row (Figure 1), real wages of American workers are up over the last year (Figure 2) and the recent UAW and Ford agreements that provided a record pay raise to auto workers. Not to mention the increase in employment and investment in the semiconductor and green energy sectors that are integral to a strong manufacturing future in the U.S.

Figure 1: U.S. Unemployment Rate, 1980 – Current

Figure 2: Full Time Employees weekly real earnings, 1980 – Current

Politically it is customary to credit the administration for things that happen under its watch, hence the President deserves credit for all the good things that have happened. But that is not the relevant question we want to ask. The real question is whether many of those things would have happened even if Bidenomics had not been implemented? And, whether things would have been even better absent Bidenomics? The answer to these questions leads us to doubt the likelihood that the Bidenomics policy initiatives will deliver the goods that the president is promising. Let us consider the counterarguments.

Figure 1 shows an abrupt increase and decrease in the unemployment rate surrounding the pandemic. The spike and recovery are easily explained in the context of a total economic shutdown and a reopening and recovery. It just so happens that the reopening coincides with the election of President Biden. Viewed from this perspective, the recovery and the increase in employment and high real GDP growth rate during the recovery are due to the reopening, not to the Bidenomics policy initiatives. One can argue that Bidenomics, just like Obamanomics, resulted in an increase in the regulatory burden that prevented the economy from reaching its prior potential output.

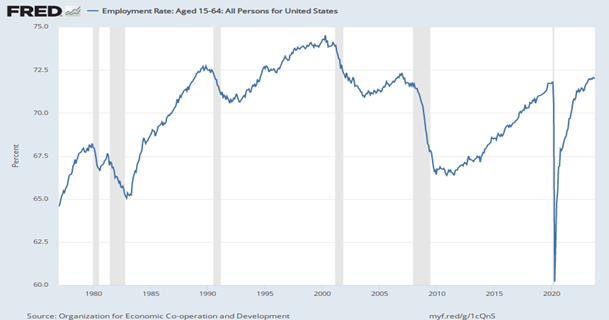

The employment rate data reported in Figure 2 allows us to present a different interpretation. Notice the abrupt decline and recovery of the employment rate surrounding the pandemic. Hence both the employment and unemployment rates are consistent with the result that the spike was due to the closing and reopening of the economy. The data reported in Figure 2 shows that prior to 2000, the peaks in employment increased secularly and since then they have declined. What can explain the secular trends and turning point? Our answer is the incentive structure. During the 1980-2000 period tax rates were significantly reduced and during the Clinton administration the welfare system was reformed and replaced by workfare. These reforms increased the incentives to work and resulted in a higher employment rate (Figure 3).

Figure 3: U.S. Employment Rate Ages 15-64, 1980 – Current

George W Bush, the compassionate conservative, was elected and his policies led to an increase in the economic regulatory burden thereby reducing the incentives to work. He implemented the “no child left behind” policy as well as other legislation that reduced the incentives to work for those people ensnared in the compassionate conservative means testing income trap. Many of these policies were further expanded and added on to by the Obama administration. The increase in disincentives prevented the employment rate from reaching new or previous heights. Those who withdrew from the labor force would experience a skill deterioration, thereby reducing their employment opportunities. In due course they would become unemployable. The joint interpretation of the unemployment and employment rates are not too kind to Bidenomics and suggest that as the administration doubles down on its policies, the pace of economic activity will decline to something similar or lower than the growth rate during the Obama administration’s second term.

Doubling down on Bidenomics means an increased regulatory burden going forward. If President Biden gets reelected a tax rate increase is inevitable as the Trump personal income tax rate cuts passed under a reconciliation procedure are due to expire. There is no way that the Republicans will be able to gain sixty Senator’s votes to extend the Trump cuts and override a Biden veto. Higher tax rates, increased regulations, greater government intrusion and an industrial policy are not the ingredients for faster economic growth, in our opinion. We look for 2024 real GDP growth rate to be lower than 2023, more likely in the 1.5% to 2% range.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments