It goes without saying that the past several years have been momentous in many respects, including in the realms of economics and investment markets. Well before COVID and the extraordinary fiscal and monetary response to the pandemic, a controversial theory had been dominating economic thinking for more than a decade called Modern Monetary Theory (MMT). In summary, it is the concept that central banks could support government fiscal policy initiatives through money creation and expansion of their balance sheets. Deficit spending to implement tax cuts, social welfare programs, defense programs, private sector bailouts, public sector bailouts, environmental initiatives, etc. could all be financed by central banks through government bond purchases and low interest rates. Initially adopted by the Bank of Japan to fight off demographically driven deflationary pressures, then implemented by the Federal Reserve on the back of the 2008 financial crisis and ultimately utilized by the European Central Bank to “do whatever it takes” to hold the Euro together, everyone became a fan of MMT. Low rates, low inflation, economic growth, and rising asset prices. What was not to like? Sure, there were curmudgeons like Ron Paul who eschewed MMT and warned that this theory was neither new nor novel, that it had been tried before and there would be a reckoning for embracing this policy. Well, it appears as if we may be experiencing that reckoning today as investment markets of all types and varieties are experiencing large drawdowns reflecting the sharp increase in inflation, interest rates, and cost of capital for the private sector.

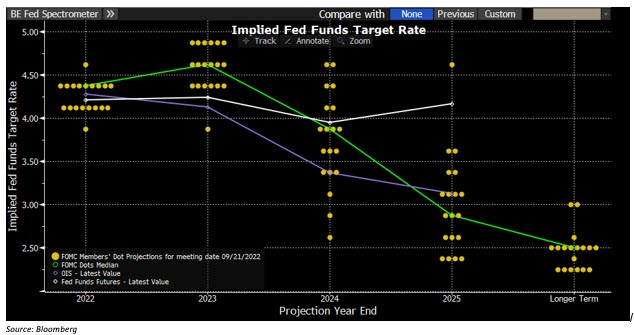

To be fair, most investors have understood the risks of MMT at one level or another. Understood that the economy and markets were being overly stimulated by monetary policy but believed that an orderly unwind was plausible as the COVID crisis had receded and the economy was fundamentally solid. Yet, as we now know, the policy driven inflation has proved to be less contained and much less transitory than initially anticipated and monetary policy has been forced to be more aggressive by raising rates and

tapering the central bank balance sheets. And over the past several weeks, Jerome Powell and other Fed governors have made it more than clear that until inflation moves back to its long-term target of 2%, investors can expect further interest rate increases and more economic and market disruptions; explicitly stating that cooling asset prices and employment trends are near term objectives. A reckoning, indeed.

Yet, not all economists and market participants believe that the Fed is on the right course and some like Jeremy Siegel and Ed Yardeni maintain that the Fed kept its easy policy position for far too long and is now overreacting to lagging inflationary statistics, and at this point may overtighten, causing unnecessary risks and pain to the economy and investment markets.

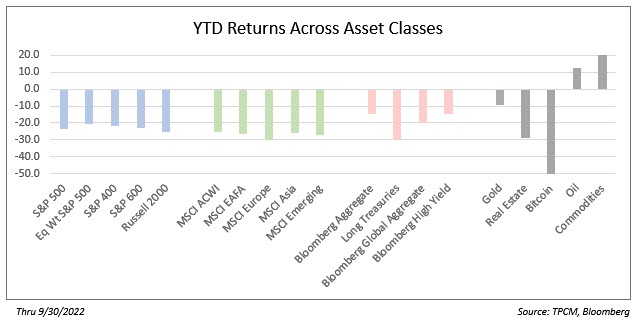

And pain is what the average investor has experienced this year as investments of all types and varieties have posted sharply negative returns. Going into 2022, many believed a market correction was in the cards. Over the three-year period from 2019 through 2021, the S&P 500 experienced a total return of over 100%. So, on the back of that, a correction was not an outlandish view and through the first four or five months of this year, the selloff in equities felt like an overdue, orderly correction in the face of a tightening Fed. Yet again it was our old friend the bond market that was telling us that something bigger may be at hand as bonds have been in the process of posting their worst year since the calculation of the Bloomberg Aggregate Bond index. Year to date, the US bond market is down over 14%. The previous worst year for bond investors was 1994 when the index was down 2.9%. Even with stocks down over 20%, one can say that the equity market has corrected but the bond market has truly crashed.

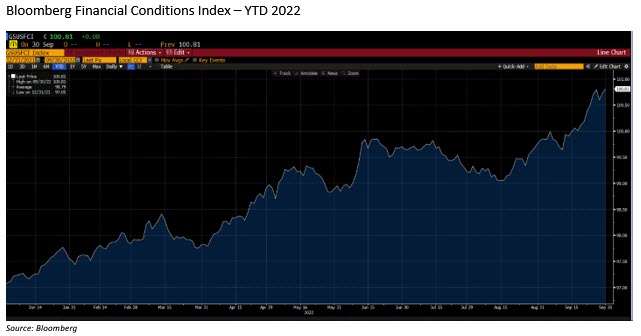

Beyond major market investing indices, several other market indicators are pointing to levels of stress within the financial system as the cost of capital reprices. The Bloomberg Financial Conditions Index, tracking the overall level of financial stress in the U.S. money, bond, and equity markets, is now at 2022 highs.

Additionally, 2022 US dollar strength is a byproduct of relative monetary policy and a growing risk variable to foreign governments and currencies. Recent shocks in the Japanese yen, British pound and Chinese renminbi all point to increasing fragility across global markets. And now concerns of the viability of two European banks have become another risk, reminiscent of 2008. Historically, the Fed “breaks” something when embarking on aggressive monetary tightening. All eyes are on weak hands, public and private, as sources of potential systemic risk.

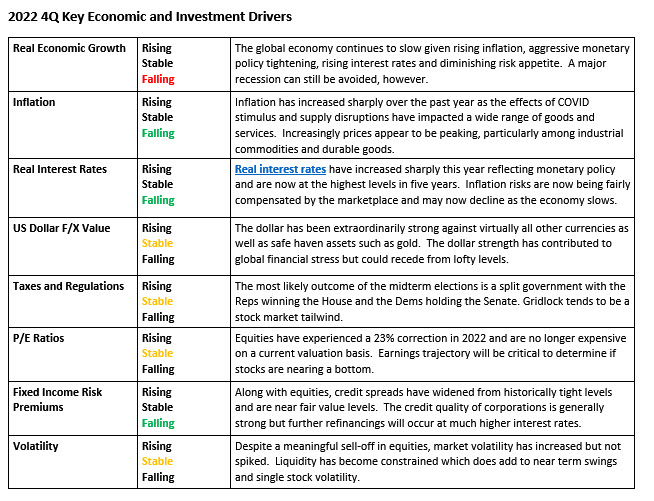

So going into the fourth quarter, it’s fair to say there remains plenty to worry about. But is there a bull case, at all? Are there any signals that lead us to believe there is an end to this extraordinarily difficult investing environment? Fundamentally, virtually all is contingent on falling inflation and rate stabilization of monetary policy. To the extent that inflation begins to subside, and economic risks continue to skew to the downside, the market will anticipate the Fed taking their foot off the tightening accelerator.

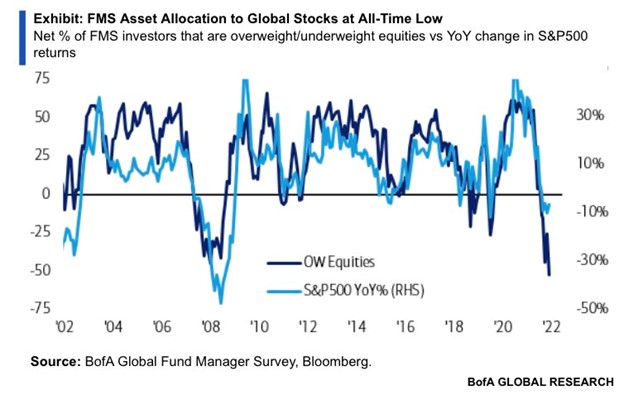

Investor sentiment is another variable that is currently so negative that it is positive as both individual and institutional investors have reduced risk assets to levels not seen since the depths of the financial crisis. And it is not just equities, bond market sentiment is also washed out.

Price and liquidity tend to dominate during volatile times, but sentiment is an important variable as well which can lead to dramatic inflection points. We have seen washed out sentiment several times this year and ultimately fundamentals rule the day. Yet investors today have priced in some very bad news including at least 75bps of future Fed tightening, a recession, and the collapse of a European financial institution or two. At this point market participants need to ask themselves, “Can you fall out of a basement window?”

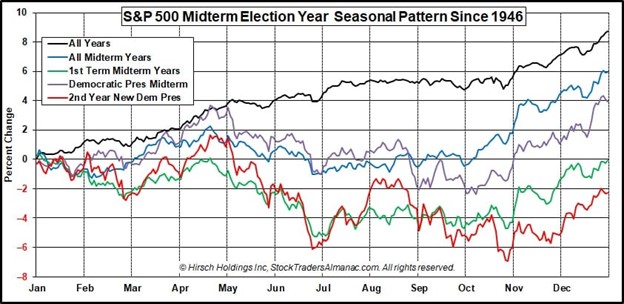

Seasonality also favors the bulls as the fourth quarter typically is a strong investing period and particularly so during a midterm election year. Much can be made regarding this year’s election and the likely outcome of a split government with the Republicans winning the House and the Democrats holding the Senate. Gridlock is the favorite mode of governance among investors and a Republican House will likely quell the most anti-growth initiatives of the Biden Administration.

In terms of asset class and sector outlook, we have gravitated towards mostly neutral viewpoints around most major market asset classes which will lead to roughly neutral weightings in client asset allocations, particularly between stocks and bonds. There are a few notable exceptions. For the first time in nearly two years, we have developed a constructive viewpoint on fixed income investments and believe bonds will outperform cash. As mentioned above, the bond market has sharply repriced lower and real yields are at the highest level in five years, which we believe creates opportunities for bond investors to make money. Additionally, we believe that credit spreads are attractive and in the absence of a major recession should provide additional return. Among equities, we remain overweight the US and overweight smaller capitalization stocks. Valuations are compelling in small caps and should provide a better return profile than large cap equities. We will remain overweight non-traditional alternatives which should help portfolios navigate the inevitable volatility which will occur between now and year end.

Lastly, we’ll end on an optimistic note. According to Compound Capital Advisors, to date 2022 has proven to be the worst year for a 60/40 balanced portfolio since 2008 and the second worst year since 1928. Yet, the annualized rate of return over the entire 95-year period exceeds 8%, proving that over time, investors are compensated for taking risk. While most investors do not have a 95-year time horizon, when looking at the 10-year period ending 1937, which includes the Crash of 1929 as well as the bulk of the Great Depression, the 60/40 portfolio eked out an annualized 2.4% return. Also, during the inflation ridden 1970s, the 60/40 portfolio posted an annualized return of 6.1%. History has proven that through boom times and busts, markets and investors adjust, and volatility is often the price of admission for future returns.

A Fed reckoning for sure, one that has led to a recalibration of future return expectations. Rather than MMT, investors should probably have been focused on the oldest of investment maxim’s, “Don’t fight the Fed”. But in the Fed’s actions are the seeds of recovery and, in due time, investors will again be rewarded for their participation with risk assets.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments