The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

What is the argument for an economic soft landing…?

- Our belief is that inflation has peaked…recent wage report encouraging, as were CPI and PCE reports

- Yes, food and energy declines helped headline CPI report but OER and shelter will be supportive of further core CPI decreases, albeit with lag effect

- 25bps hikes in the future to 5% as Powell continues to channel his inner Volcker…then a pause

- Employment trends remain robust despite high profile layoff announcements; JOLTS openings stay robust

- Initial unemployment claims peaked in June and are trending down…continuing claims now starting to recede

- Consumer spending remains buoyant, watching credit and savings rate levels

- U.S. ISM is sub 50…eyes wide open…we have seen numerous instances of sub 50 readings without recession

- Atlanta Fed GDPNow estimating 4% GDP growth for 4Q22…quite a comeback from 1H22. 1Q & 2Q 2023 are lapping negative GDP prints

- Markets are coming to grips with rapid exit from ZIRP…this was a surprise in ’22, not in ‘23

- 2H22 SPX 500 was up 2.3% with small caps and high yield, risk elements in the market, outperforming

- Fixed income now providing attractive yields given slowing inflation and growth environment

- Political winds are changing…perhaps…Republicans “control” of House and recent Freedom Caucus “revolt” may help to rein in future spending

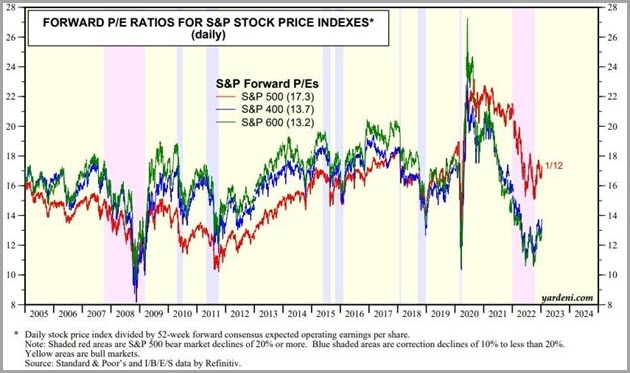

- Lower interest rates will help provide floor on P/E multiples, have provided what we believe will be short term boost to growth names

- Another goldilocks economy? We see inflation receding and 2% – 3% GDP over next 12 months

Can U.S. small cap turn the tide versus large caps in 2023…?

- Small caps peaked in March ’21 and were range bound for a year (ex a few week period in Nov ’21) before falling 21.5% in 2022

- Relative price performance of small vs. large is back to 2004 levels…provides opportunity for 15% – 20% rebound to low end of prior valuation channel

- Small Cap valuation (S&P 600) has corrected back to GFC levels…see chart above

- Small cap relative performance off prior market bottoms can be compelling…2003, GFC and 2018 lows

- Since 1995, the Russell 2000 has only one period with two consecutive negative annual return periods (2007/2008)

- Average gain of the Russell 2000 following a down year (ex 2007/2008, 6 years) is 21.7%…

- Structurally, on-shoring should benefit small cap revenue stream…margins will be a function of pricing appropriately for higher labor costs

- R2000 chart has mended itself, price action now back above the 150 dma and trending up…yes, there is overhead supply to work through

- Watch high yield and risk spreads – if our call for lower yields and tighter spreads is right, we will see small caps outperform

- Our observation is that small caps do well when regulatory vigilance is on the rise as they fly under increased regulatory and compliance hurdles

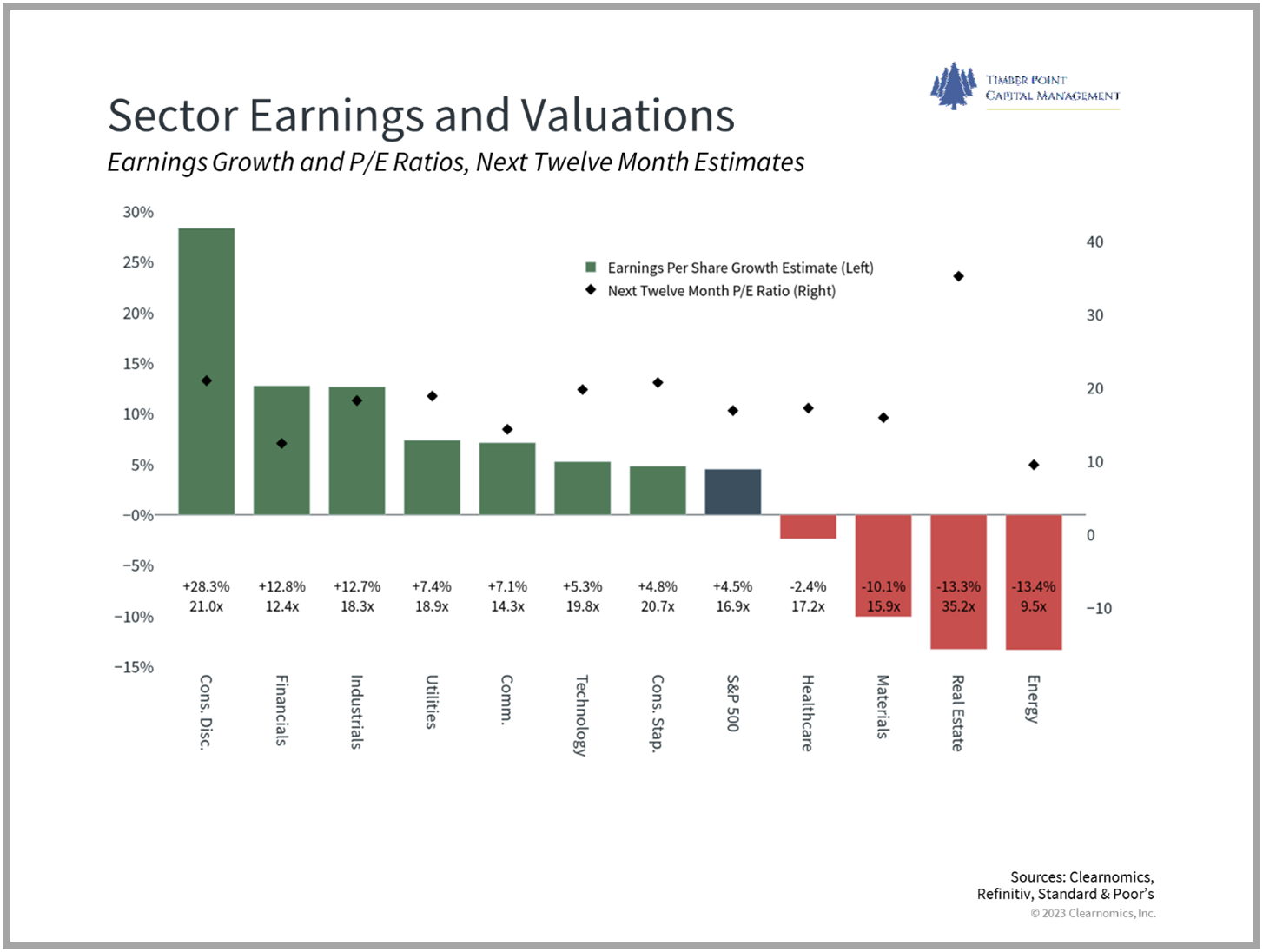

Equity market leadership continues rotation now that inflation appears to have peaked…

- YTD down capitalization rally continues…U.S. micro-cap (IWC) and small cap (IWM) have both outperformed the S&P 500 return (8.1% vs. 7.2% vs. 4.1%)

- We think small caps continue to outperform as inflation declines and growth slows, but sustains

- Our inclination is to look beyond damaged tech names…they may rebound but returning to prior valuations requires revenue growth acceleration we don’t see

- If we play technology, semiconductors have been savaged due to overcapacity…appear to have bottomed, look at NVDA, AMBA

- Healthcare names can be both defensive and offensive…XBI appears to be breaking out

- Unlikely that energy outperforms for 3rd consecutive year but have become attractive yield plays as we do not believe that crude craters

- Banks are cheap but impaired by inverted yield curve…insurance benefitting from higher rates, asset managers are a good long term bet on market recovery

- Industrial names with greater ROW exposure should benefit from declining dollar

- We are looking at equal weighted indices vs. cap weighted given FAANGM is broken and still 13% of S&P 500

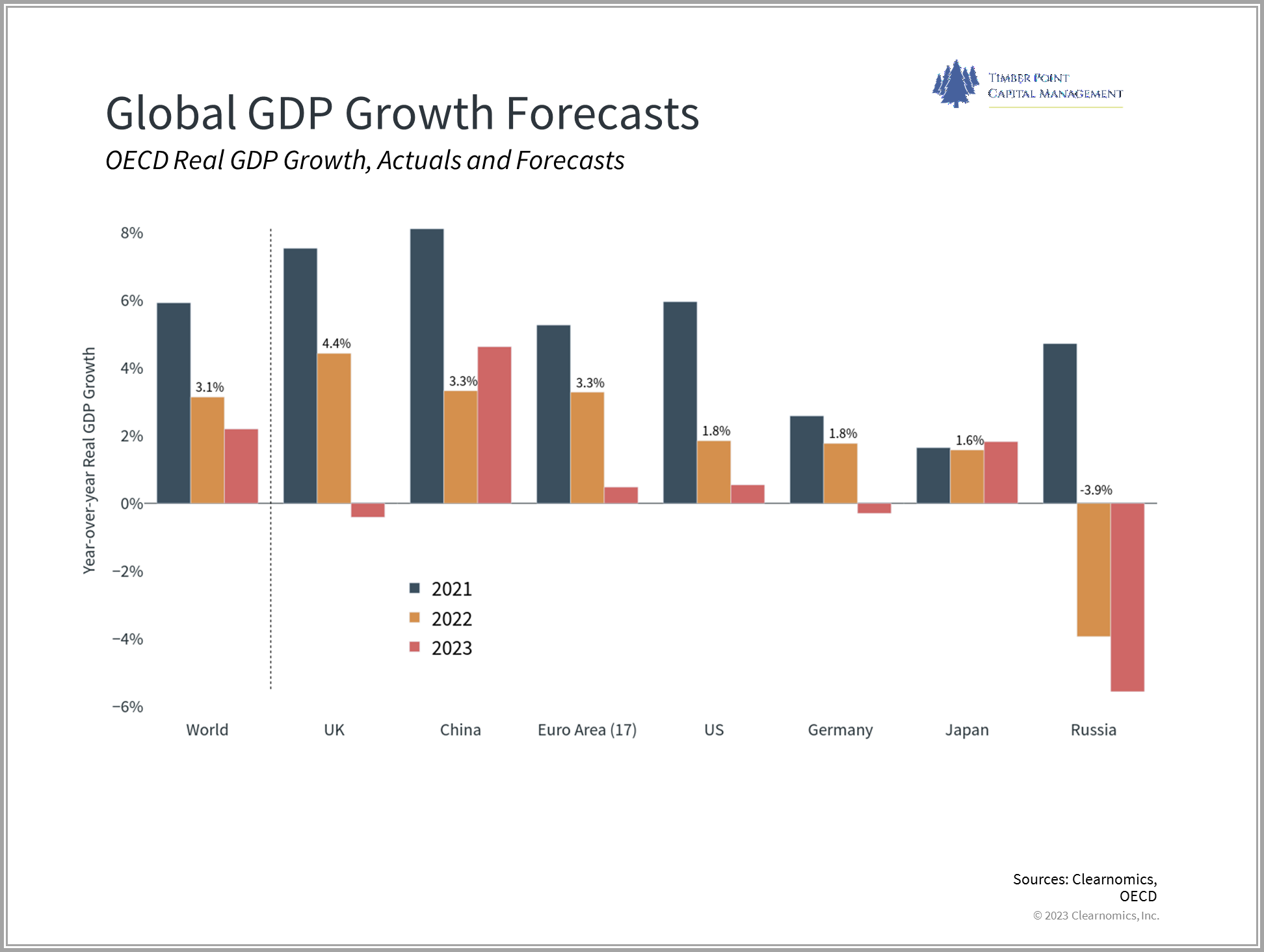

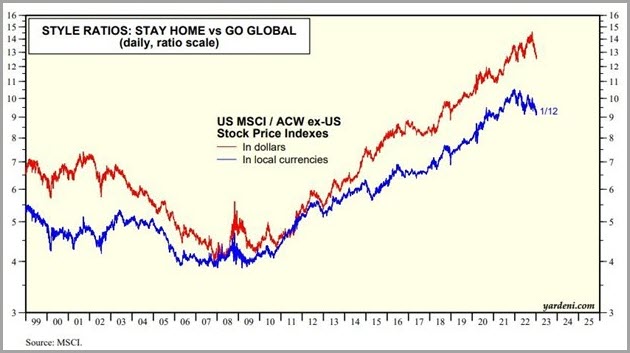

Looking at international markets…not just a China re-opening play

- Most significant event in 2023 could be the continued decline in the U.S. dollar

- Why should U.S. dollar decline continue? More aggressive rate hikes in ROW as Fed pauses soon while ROW catches up

- Declining U.S. dollar has and should continue to provide a tailwind for international equities

- International equities have LONG way to go to return to median performance trend vs. US…see chart above

- Further, countries with U.S. dollar denominated debt will be advantaged by weaker dollar…Top 5: UK, France, Germany, Japan, China

- Valuations in ROW continue to be attractive…tipping point may be that high eps growth rate of U.S. market now normalizing

- International market indices are less exposed to technology, could be tailwind if facing “innovation recession”

- Hard to fall out of basement window! German GDP has flatlined for 10 years…valuations reflect such and economic risks are priced in…

- Germany is driver of european growth, reevaluating energy production infrastructure and commitment to green energy

- France reforming “unsustainable” pension system…small changes but right direction

- UK getting fiscal house in order with austerity program…painful but necessary

- Is China really done with Zero Covid policy? Appears so and tough to back track at this point…

- China is in control of ALL of its companies but appears to be stepping off the brake in terms of oversight and profit “villainization”

- China is 1/3 of Emerging Market ETFs…EEM ETF has bottomed and now above its 150 dma

- China recovery will be muted by ongoing real estate hangover, positive but not boom times for commodities

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments