The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Checking in on the consumer…still slinging it, but feeling meh…

- How long can the consumer stay strong? That seems to be the question after the Advanced GDP number of 4.9%…we decided to take a look at a few key data points to assess..

- On the jobs front…Weekly US initial unemployment claims have taken a step down…after averaging ~ 240K from March thru August, the last few weeks are barely above 200K suggesting demand for labor remains strong – the UAW strike or Yellow bankruptcy appears not to be impacting…yet.

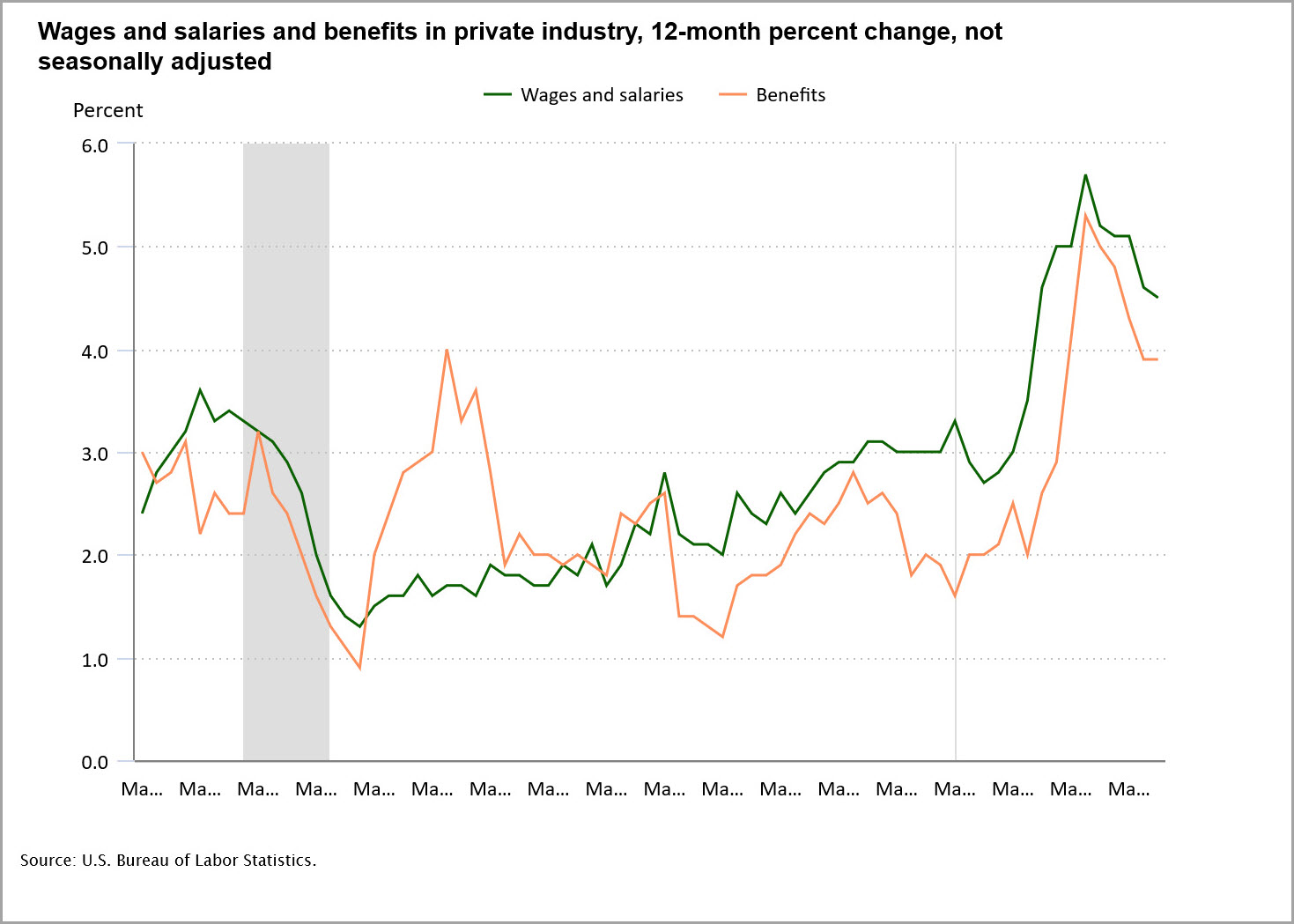

- Wages remain strong…per the Employment Cost Index, 12-month change in private industry wages/salaries grew by 4.5% in September…this is down from its June ’22 peak of 5.7% but far above its 2006 – 2020 average of 2-3%…

- While personal savings has ticked down a bit it is still at average levels for the past 10 years.. disposable personal income growth long term trend of growth in the msd range is intact…

- Both of which are fueling consumer spending…Advance estimates of Retail sales in September were above consensus estimates (increase of .7% vs. .3%) and August was revised higher…health/personal care, e-commerce and food service/drinking places were strongest – a strange mix of staples, secular trend and discretionary spend…

- Personal consumption expenditures ex Food and Energy declined to longer term growth levels in the 2-3% range after spiking to 5-6% growth in early/mid 2022…negative growth has occurred only twice in the last 60+ years (GFC and 2020)…

- Delinquency rates on credit cards and on consumer loans are rising but are nowhere near levels going back to 1991…what appears most alarming is delinquencies on All Loans/Leases/Credit Cards to Consumers which is at its highest level ex immediately post GFC…

- We also searched Google Trends and “credit card debt” and found rising level of inquiries that after a long period of dormancy, now are approaching 2009 levels…people appear to be concerned

- Perhaps reflecting this, US consumer sentiment (U of Michigan) is on the rise but only after declining below GFC levels in mid ’22…improving inflation trends are helping but cumulative inflation is likely a reason readings are still at past recession levels

- Bottom line, there appears to be some disconnect between the “establishment” numbers which paint the picture of a solid labor market, accelerating wage gains and strong income levels which support the gains we have seen in consumer spending…on the flip side, consumers appear to be stretching beyond what can be seen in the numbers as reflected in delinquencies and poor sentiment.

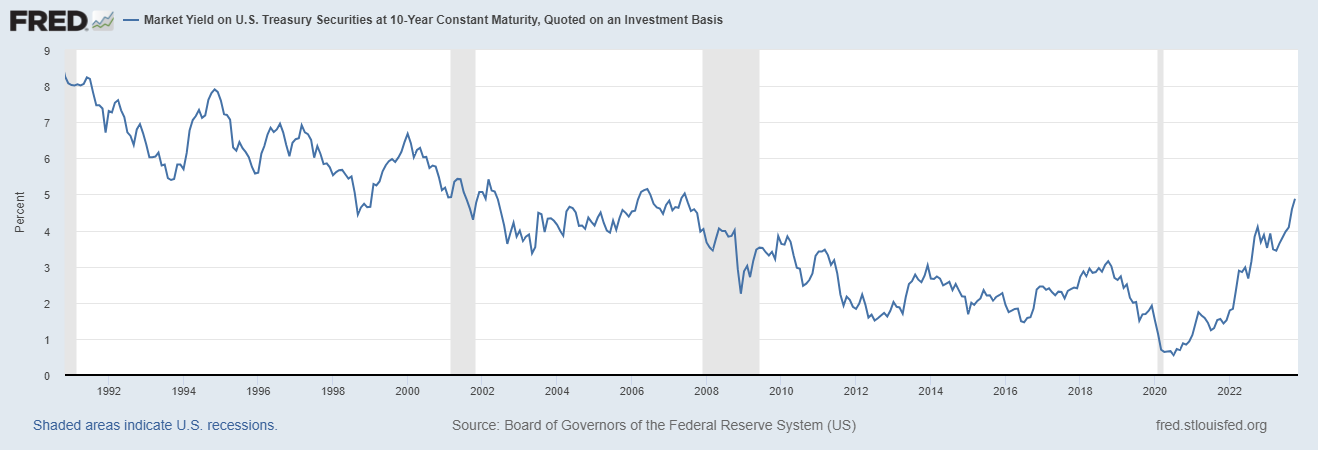

Is there an end in sight to the rise in fixed income yields?

- Yes, 3Q23 Real GDP (Advance Estimate) increased by 4.9%…far more resilient than most imagined (count us in)…strong employment continues to buoy the consumer

- Inflation is stubborn, but receding…core PCE price index clocks in at .3% m/m, a slight acceleration from past few months…y/y core increases 3.7% vs. 5.1% (sept ’22)…trend is our friend, shelter should aid continued decline over time

- Fed continues on hold with Powell stating that sell off in long end of curve is helping the Fed…other lieutenants reinforce the story

- Ackman has covered his bond short based on too much danger in the world…but the war on two continents hasn’t stopped the rise in yields…yet.

- Government deficits, funding requirements, lack of foreign buyers are all making people afraid of venturing out further on the curve…

- Why not hide out in the front end? Reinvestment risk seems low if “…for longer” is real

- Or maybe “higher for longer” could meet the same fate as “inflation is transitory”…

- If there is a mild recession you will see the curve steepen…However, the Fed will need to see a few months of data and lower inflation trajectory before it will act to undo its tightening

- Are we seeing the beginning of rising consumer strain in low FICO score borrowers? Delinquency rate on credit among smaller banks is at highs back to 1991…

- While credit spreads remain restrained in the corporate sector…BBB’s and high yield spreads bounced a bit in Sept/early Oct, but still below ‘22/’23 highs and no sense of panic..

- Could the mantra shift to “higher for how much longer?”…unlikely absent weak economic data

- We are tempted to increase duration in the fixed income portfolio…TLT has had equity like drawdown of ~ 15% in 2023, everybody is on one side of the boat…

- Investment grade corporates offer attractive real yields, and safety, if the economy does slip into recession…corporate balance sheets are strong post refinancings of the last few years

- High yield not a go to asset in a weak-ish economy…spreads are tight and yields are below 10-15 year levels…we understand HY has higher quality issuance (more BB’s) vs. history as an offset

- Using the the equity risk premium, bonds are cheap relative to stocks…

- Stay safe, stay liquid, maybe we are at a slight pivot point…additions to duration make sense in our mind given current levels and the speed with which we arrived here…

________________________________________________________________________________________________________________________________________

Healthcare…GLP-1’s are putting medical device stocks on a diet…

- The emergence of GLP-1’s (Ozempic, Wegovy, Mounjaro) are creating a potentially enormous new opportunity ($100b??) in the obesity market

- Further, studies are showing that GLP-1’s can have positive impact on other health issues, namely cardiac and kidney disease

- Ultimately, market penetration and size will come down to a host of factors including cost, payor reimbursement, capacity ramp and how many, and how soon, new entrants are able to move into the space

- There are also questions over the side effect profile which could impact adherence to chronic usage which could result in only temporary weight loss when treatment is stopped

- One casualty of the GLP-1 gold rush are medical device names, including diabetes (CGM and pumps) and orthopedic device manufacturers, which have had woeful performance as evidenced by the iShares US Medical Devices ETF (IHI), down 20% YTD

- The question is whether this is an investor overreaction, or will prior resilient long term growth markets be impacted negatively, and sustainably, by the uptake of GLP-1’s?

- At first blush, it makes sense that investors questioning market growth and TAM’s will quickly discount valuations of companies that are exposed to potential competitive threats

- It also makes sense that if a verdict on end market dynamics with will take several quarters, if not years, to become clear that investors will gravitate to areas with more certain growth prospects

- However, the orthopedic market has proven durable over years and the continued aging of the U.S. population will fuel an ever-growing pipeline of potential customers

- Oddly, adding to this pipeline could be the successful uptake of GLP-1’s that actually allow, over time, more people to lower their BMI and actually get off the couch and be more active…

- Further, to the extent that some patients are turned away for high BMI’s, more use of GLP-1’s could turn to a slight tailwind

- To the extent that GLP-1’s have a longer run way to market expansion due to cost restrictions and/or slower payor uptake, there could be a reconsideration of the near and medium impact to medical device markets in general

- Despite the stock price declines, valuation for SYK is not exactly cheap at 23x 2024 eps (+11%). ZBH is more reasonable at 13x 2024 eps with high single digit growth…

- Only time will tell of course, but will be focused on SYK’s earnings (11/2) and Investor Day (11/8) as well as ZBH earnings (11/7) for further clarity on future earnings trajectory for the medical device industry in general and the orthopedics sector specifically

________________________________________________________________________________________________________________________________________

“The people’s house is back in business”…Mike Johnson takes over as Speaker of the House

- Three weeks after the Gaetz Gang ousted Kevin McCarthy as Speaker, we have a new leader in the House…and it isn’t one of the usual suspects

- Attempts by Steve Scalise and Jim Jordan failed miserably and, thankfully, relatively quickly…or at least when compared to McCarthy’s 15 ballots earlier this year

- McCarthy’s ouster was supposed to create chaos and a leadership vacuum, just as it seemed leadership was needed most (two wars, looming budget deadline, upcoming 2024 election)

- And maybe it did, for a brief while…but the Republican’s, no doubt exhausted, were unwilling to let the process play out any longer and went with the least “bad” choice, Johnson…

- So, who is Mike Johnson, who has pledged to “…restore the people’s faith in this House.”? You can listen to his excellent acceptance speech here, if you missed it…

- The first Speaker from LA, Johnson is a constitutional lawyer by training who spent one term as a LA state representative before being elected to Congress in 2017…he sits on the Judiciary Cmte and the Armed Service Cmte

- He has been branded as “far right” by most media outlets for his support in overturning election 2020 results as well as his abortion views (return to states, 20-week ban)

- Johnson supported the effort in Ukraine but now is turning more skeptical…he is now forcing a stand-alone vote on aid for Israel…the Democrat’s want funding tie to Ukraine…

- Johnson has been dogged about government overreach (FBI) and censorship of social media

- He has called for action on the Southern border as illegal migrants are taxing city resources and providing an on ramp for fentanyl

- Perhaps most importantly, Johnson called out the impact of skyrocketing inflation, unlimited government spending and the “unsustainable” national debt – he has promised a bipartisan debt committee immediately

- How he will differ from McCarthy will be on display shortly with a government shutdown looming on November 17th…remember McCarthy’s ouster was largely a result of his willingness to negotiate with Democrat’s over the debt ceiling and averting a government shutdown

- Speaker Johnson’s ability to lead a fractious party and partisan House will be quickly and severely tested

________________________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Recent Comments