The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Recession, what recession? Economic data punches back on the recent worries…

- “Employment numbers remain strong” – now that’s an understatement with unemployment and Initial Unemployment Claims at 50 year lows…

- Yes, employment is a lagging indicator…companies don’t fire until they see the whites of the recession’s eyes…

- And layoffs have spread from big tech but small and medium size business is picking up the slack

- As a result, consumers are spending…Advanced Retail sales are strong up 3% m/m…only negative group y/y was Electronics/appliance stores at (6.4%)

- Atlanta Fed GDPNow suggesting 2% growth…New York Fed Weekly Economic Index estimate of 1.3%

- Citi Economic Surprise Index have turned up, especially in Eurozone where weather has helped it avert a serious energy crisis…for the time being

- We aren’t pollyannish…recent ISM services, CPI and PPI prints will reinforce that the Fed is not done yet…that is not new news…

- We think Fed still targets 5% (2 more hikes of 25bps each) and then waits to see lag effect on the economy…

- Inflation expectations are still anchored…progress may be slow but soon OER and shelter will start to roll over as rental prices continue to decline

- Bottom line…economy may be at peak employment but no reason to believe things will quickly roll over…this supports the consumer which supports continued economic growth

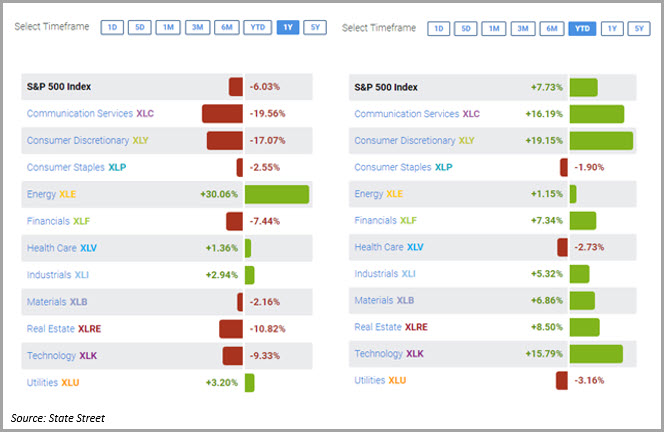

Stock markets levitate like a Chinese spy balloon to start the year….

- Negative sentiment and cautious positioning to start the year left investors “offsides” when growth caught a bid..

- What was worst has now become first…2022 laggard groups have been the biggest winners YTD (chart above)

- Communication Services, Consumer Discretionary and Technology SPDR ETF’s have all benefitted from large cap gains

- YTD, META up 43%, AMZN up 17%, TSLA up 64%, AAPL up 18.5%, MSFT up 10% vs. SPX up 6.8%…all have big weights in SPDR ETF’s

- Risk on has flowed into small caps as well, both Russell 2000 and S&P 600 up 10%+ YTD

- Did you call NASDAQ up 15%, Europe up 10% with France and Germany up 13% and 14%…??

- This is not just a mega cap trade…equal weighted indices are also performing well…Large cap (RSP) up 7.2% and small cap (EWSC) up 12.1%…

- Economic data, noted above, has been solid…4Q earnings less so, but not disastrous

- Per Factset, 69% of companies in 4Q22 beat estimates and by only 1.1%, which is below the 5 year average of 77% and 8.6%, respectively

- However, fears of significant cuts to 2023 earnings have not materialized…

- 2023 earnings expected to show low single digit growth of 3%..albeit are 2H23 loaded…yes, this continues the downward migration of 2023 estimates

- Initial 2024 earnings of $249 would represent earnings growth of 11%…a level where 2023 earnings were estimated to end up in early 2022…

- For perspective, need to remember that S&P 500 earnings in 2019 were $163…2023 earnings estimated to be $224…

- Without a significant decline in earnings power, and with a still hawkish Fed, we see an S&P 500 trading range of 15x – 18x, or 3400 – 4100

- If 2024 earnings estimates prove to be real…4400 – 4500 S&P 500 is in the cards over next 6-12 months…that still does not get back to prior peaks…

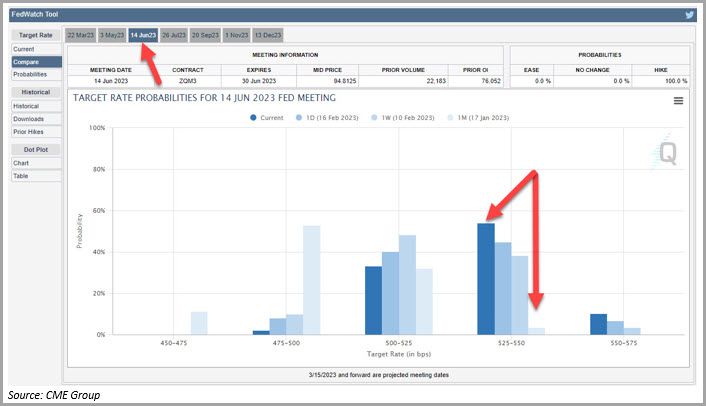

Former Regional Fed President’s speak up…be more data dependent!

- Former Fed regional President’s Lacker and Plosser penned a recent piece in the WSJ outlining how they believe the Fed should be less opaque in setting Fed monetary policy

- Given the slowing progress in recent CPI and PPI prints we thought it interesting to note…investors now see a > 50% chance of a 25bps hike at the June Fed meeting (chart above)

- The gist of the article was that the Fed should be far more transparent about the tightening needed to achieve its price stability goals

- “Concrete guidance” via economic models could help to inform market participants as to the tightening amount needed to achieve price stability

- “Systematic monetary policy rules”, ala the Taylor rule, have been successful at reducing inflation in the past and should be highlighted

- Using such rules would prescribe a current funds rate of almost 8%, indicating how far behind the Fed currently is in achieving price stability

- “Rules based” monetary policy would have forced the Fed’s hand in 2Q/3Q 2021 rather than March 2022

- Assuming that inflation will subside rapidly, averaging about 3% for the year, and unemployment will move slightly higher, 2023 exit rate of 5% seems appropriate

- However, if inflation continues at the current four quarter rate of 5.5% (note that trailing 3 month inflation is 3%-ish) policy rules would recommend a 6.5% to 8% funds rate by year end

- Bottom line, helping the market understand the policy rules and how they inform Fed thinking could lessen the gap between market expectations and actual Fed policy

- Given the current disconnect between the dot plots and market expectations, this is a laudable goal but potentially gives the Fed less wiggle room and could create more volatility as rates move up/down more freely

- The Cleveland and Atlanta Fed post do-it-yourself Fed funds calculators online…see for yourself…

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments