The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Victor Canto, PhD on current monetary indications…key points include:

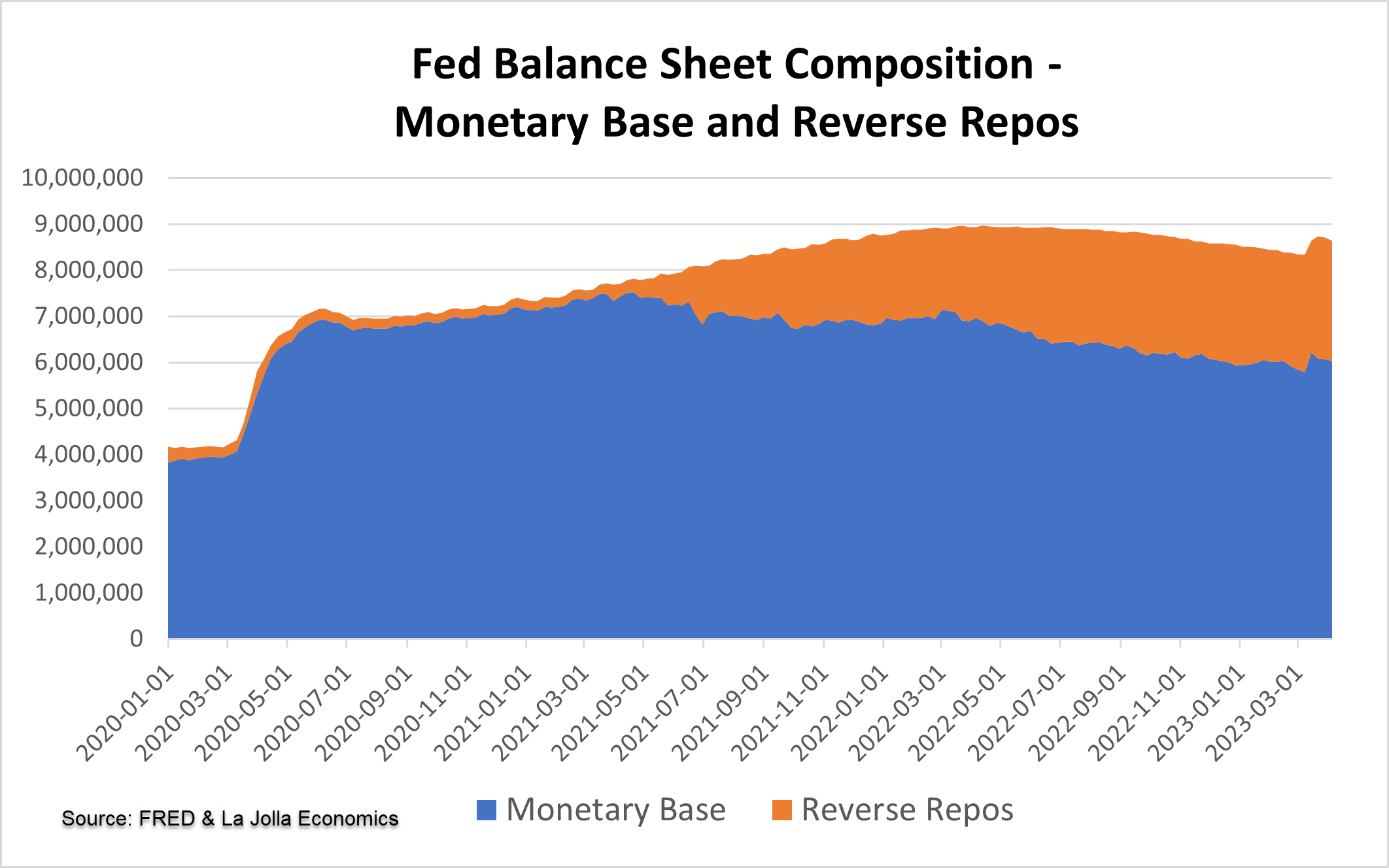

- The Fed balance sheet has been slowly contracting…however, the SVB crisis has unwound a large portion of the reduction

- Over the past year, reverse repos (RR) have increased from 0% of the Fed’s balance to 30%…

- The increase in the RR’s, especially when lagged, corresponds well to the T-bill yield uptick

- Increases in the monetary base leads M2…which leads the inflation rate…especially convincing when the data is lagged by 12 months…

- Both the monetary base and M2 growth rates are now negative, i.e. both aggregates are declining…given that, we expect continued decline in inflation

- The increase in RR’s on Fed balance sheet creates a new monetary and bank credit equilibrium impacting credit creation and the cost of bank credit via the money multiplier…watch this…

- As the Fed normalizes its balance sheet and eliminates reverse repos we should see lower inflation, lower short term interest rates, an increased money multiplier and an upward sloping yield curve…but this will take time…

- We still expect slow growth as opposed to recession…click here for Victor’s monetary conditions deck…

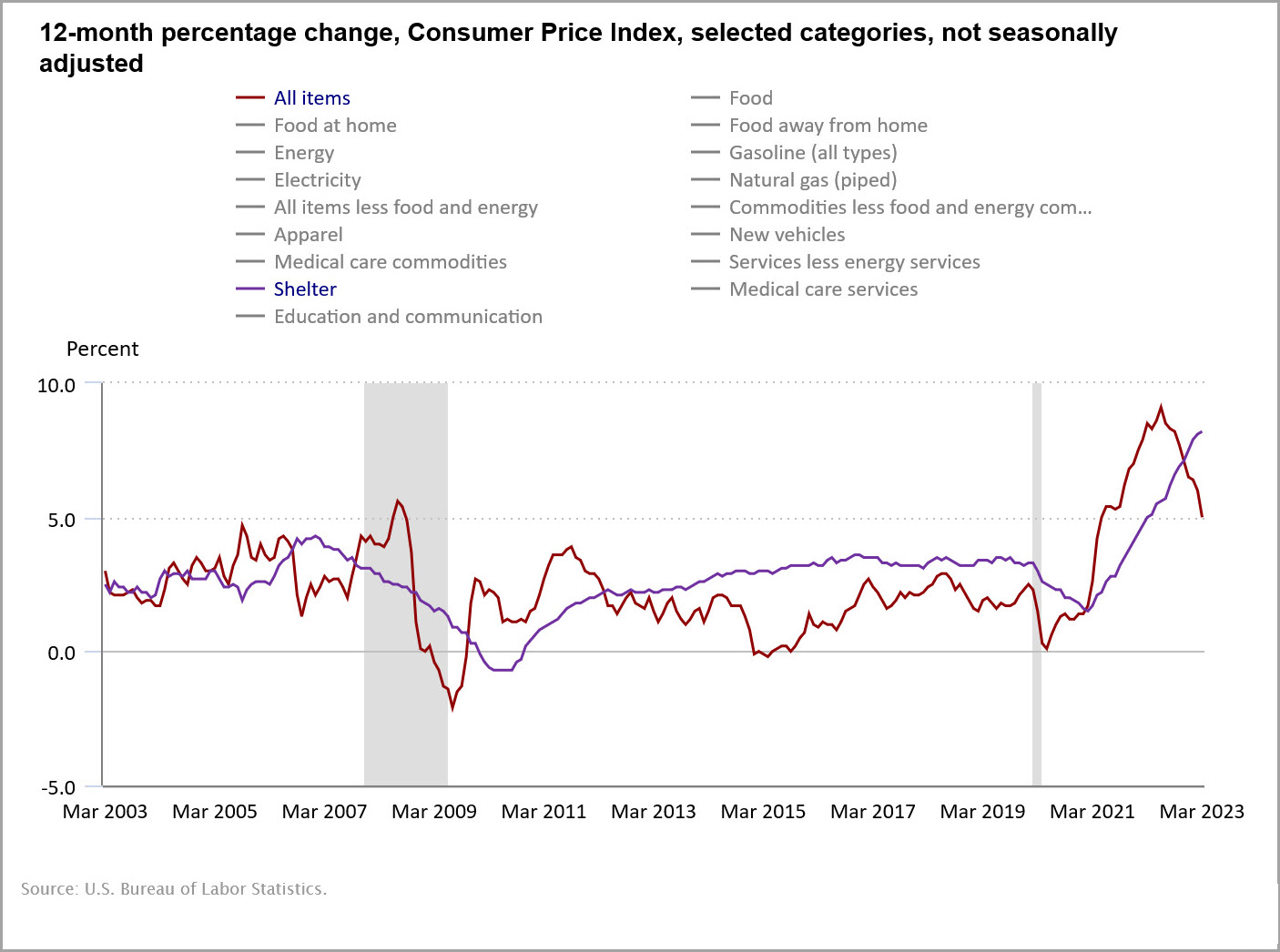

Recent inflation prints are encouraging…the pain trade is definitely higher…

- CPI and PPI prints continue the drumbeat of good news on the inflation front, expect more to come

- On CPI, shelter should be tailwind going forward…largest component at ~ 1/3 of the index – a turn there is important

- PPI was lowest since January 2021 (2.7%), lower energy prices the big driver…supply chains are resolving positively which should continue to benefit upstream pricing dynamics

- High yield spreads have recovered half of their blow out since SVB…encouraging

- CBOE VIX Index trades at the 17 level after topping out at 26 post SVB…’21 lows were in the 15 range compared to mid-2010’s level of 10…more improvement to come?

- Recession talk continues – yield curve inversion, LEI’s, PMI’s are all concerning but the market is not listening

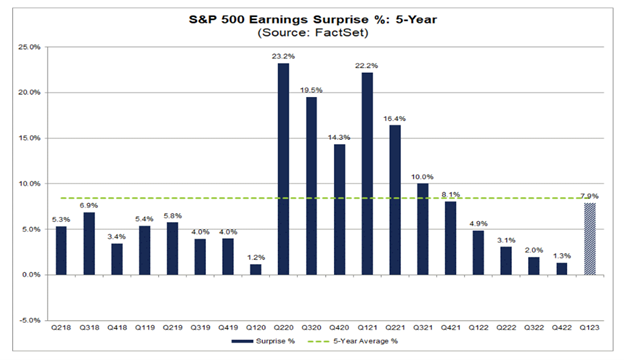

- Levels of earnings surprise have been in decline since 1Q21, posting a level of only 1.3% in 4Q22 (Factset). Earnings are estimated to decline 6.7% in 1Q23…after a 4.6% decline in 4Q22

- The market is betting that earnings are approaching trough levels near $220 for ’23…and that $240 for S&P 500 earnings in 2024 is possible…at 19x that implies upside to 4500…

- It is tough to surmise why the market does what it does at times…this is one of those time and the answer will likely appear shortly…

Earnings season starts with a JPM bang…what are we watching for?

- Sentiment is so negative in regional banks, perhaps they trip over the low hurdle? Or, does crisis move from cash sorting to credit quality, specifically office within commercial RE portfolios…

- Technology companies have been in cost cutting mode…is there more to come to maintain margins? As important, beyond AI, what are the growth drivers?

- As the economy slows and new capacity ramps, does the supply gut in memory semi’s move to logic…if so, implications for a whole bevy of manufacturers from autos to semi cap equipment

- Recent OPEC cuts show restraint and coordination amid fears of weak global growth…is recent equity price action merely a respite that should be sold into?

- Industrial distributor Fastenal reported its slowest revenue growth in 6 quarters, a still impressive 9%…given recent weak leading economic indicators, what sort of revenue gains can we expect from the industrial space?

- Are supply chain issues resolved throughout the economy? Given recent JOLTS job opening data, who is aggressively hiring or having trouble doing so?

- Medical device companies are getting back to work based on stock prices…are elective procedures really that strong?

- If the consumer remains resilient (per Dimon/JPM), why does the XRT act so heavy? This is a broad basket of retail companies (90 fairly equally wtd)…what are price vs. volume dynamics driving same store growth?

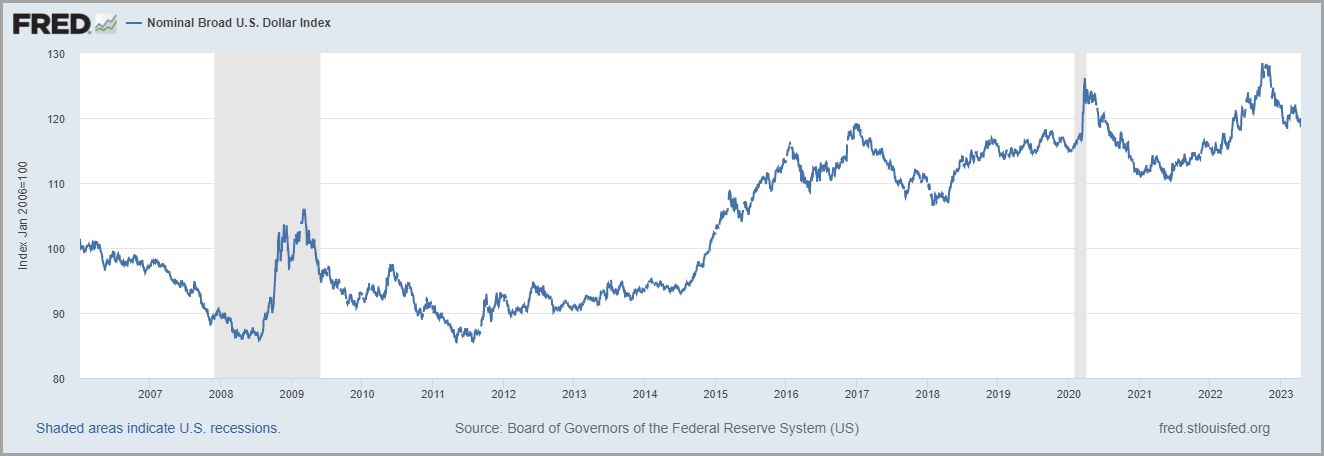

Dollar continues to decline…in a “lower for longer” outlook?

- Longer term USD trend is still intact going back to 2008 and 2011 lows…

- Fed funds are close to neutral vs. CPI inflation (5%), suggesting a pause in fed fund hikes in the near term

- Per CME, 2/3 odds that Fed pauses in June after 25bps hike in May to 500-525 bps

- Inflation rate differentials among U.S. and ROW are normalizing…Euro inflation for March expected to be in the high 6% range vs. 8.5% in February…

- S. growth rate disparity vs. ROW also contracting as U.S. downshifts to sub 2% GDP growth…in line with standard growth for Euro/Japan markets

- No evidence that USD is losing status as world’s reserve currency but it will be a slow burn if it does…

- Hard to ignore the foreign leaders making pilgrimages to China and China acting as “peace maker” around the globe…they will play the long game

- China actively looking to buy oil from Saudi and others in their currency vs. dollars

- Does declining USD pressure the US to get its economic house in order? Upcoming debt ceiling and budget talks will provide opportunity for Republicans to craft a 2024 message…

- Implications? US monetary, fiscal and policy missteps over time, along with China’s growing presence on global stage, could shift the balance of power over the long term

- Implications? We have seen outperformance of ROW, primarily Eurozone, equities vs. U.S. – we think this continues and possibly expands into APAC markets

- Implications? No doubt the recent resurrection of bitcoin has been a function of SVB bank crisis and ongoing lack of confidence in centralized monetary system

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Recent Comments