The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

S&P 500 currently trades in a tight, multi-week range…Mega-Caps are driving YTD performance

- Big dispersion between stock and bond returns…SPX and IWM up ~2% in past week while Barclays Agg and Long Treasuries are down 1.5% and 3%, respectively

- Debt limit concerns are manifesting themselves in the bond mkt…short end buyers demanding premium for potential of delayed interest/principal payments…front end CDS spikes

- Fixed income buyers worry about potential spike in issuance across the curve…Treasury General Account will need to be replenished

- Vol spreads are gapping out in municipal and credit markets as well…

- Despite the debt limit stress, still seeing issuance – AAPL and SCHW…smaller names selling portions of loan book (PACW) to replenish capital…KRE attempts to rebound

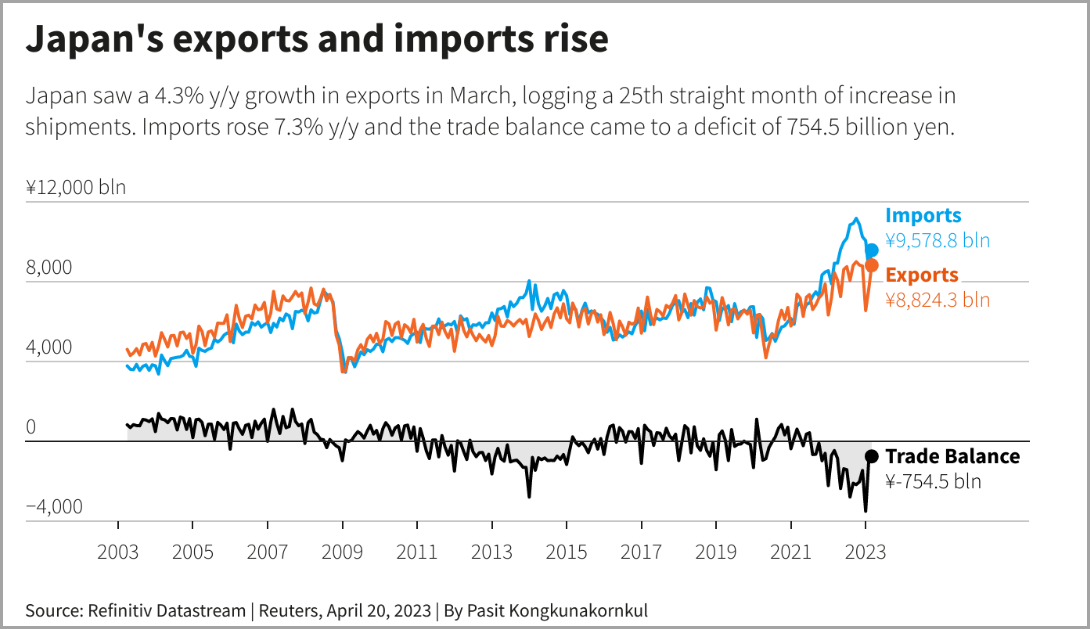

- But equity market is unfazed, AI fueled names march higher – NVDA, semi’s, semi cap eqpt…valuation disparity between mega cap generals and the rest of the SPX soldiers continues to widen (chart above)

- SPX 500 performance (up 9% YTD) largely driven by a few names…disparity in performance between SPX and RSP (SPX equal weight) is largest since 1999…same disparity in QQQ vs. IWM

- Recent uptick in interest rates started to crack high fliers in defensive groups – HSY, MCD…homebuilders get tagged despite robust results from TOL as mortgage rates tick higher

- This is a tough environment for active stock pickers that run diversified portfolios…average and median SPX stocks are flat on the year

- Small caps seeing small improvement as are financial sector heavy and emerging belief that deposit betas are stabilizing

- Small and mid-cap healthcare/biotech rebounding as seen as takeover candidates for large pharma that is running into regulatory issues with larger acquisitions (AMGN/HZNP)

- We have trimmed some winners in the portfolio (GOOG and NFLX), shorted some technology names and are looking for opportunistic purchases in financials

XRT vs. XLY – A tale of two tapes…largely reflects different fund structure…retail results are erratic

- XRT is a modified equal weight ETF of 88 holdings with average market cap of $33B

- XRT top 5 holdings are CVNA, GME, EVGO, AMZN, SIG – the top 10 names are 14% of the ETF

- XRT reflects more small and mid-cap retail names across the broad retail industry

- XLY is market cap weighted fund with 53 holdings and an average market cap of $403B

- XLY top 5 holdings are AMZN, TSLA, HD, NKE and MCD…top 10 names are 71% of the fund

- Obviously, XLY reflects large cap retail and outperformance can be driven by a few names (AMZN, TSLA)

- Over time (graph above) relative performance tends to reflect swings in large vs. small cap which tends to correct itself but there have been years of sustained performance

- Currently, large cap XLY has separated itself fairly significantly from XRT…YTD, its largest constituent AMZN is up 33% and 2nd largest TSLA is up 63%…are these really retail names?

- Retail results have been choppy to say the least…LOW and HD have talked about slowing DIY customer…AZO has struggled, ORLY has hung in there…ULTA and EL have fallen from grace while ELF has soared…SBUX has disappointed, while MCD has prospered…a real mixed bag

- We tend toward larger cap retail as better positioned to withstand a possible slowing economy and tighter credit conditions…but one has to be very careful to understand what they own if going to individual names and consider overall weighting

- Finally, the XRT should perform better in the early stages of an economic recovery as credit conditions loosen and the consumer rebounds…but we haven’t seen labor markets deteriorate yet…

- Retail sales have been choppy with m/m results negative in 4 of the past 6 months…personal savings levels have now normalized after their Covid spike

The Debt Limit Deal cometh…sometime soon…Victor Canto, PhD chimes in…

- Neither political party has a monopoly on attempts to link the debt limit to the government’s budget…the linkage is usually favored by the party not in control of the White House

- Ultimately, the negotiations and outcome can be seen as a test of strength between the two parties and sets the tone for future fiscal policies of the current Administration

- Politics as important policy in the outcome of the negotiations as both sides attempt to paint the other as undisciplined or uncaring to win the hearts and minds of voters

- In recent times, since Clinton, there have been seven actual or near shutdowns, six while a Democrat was in the White House and the Republicans held at least one chamber of Congress

- In each of these instances the Republicans were blamed for the shutdown, while in 2018 the Democrats were blamed…i.e. the party in the White House seems to escape blame

- Hence the Biden administration seeking an unlinked debt limit increase…Dem’s are playing off the that the Republicans hold a small majority and are/were seemingly fragmented pointing to a weak Speaker (McCarthy)However, McCarthy led Republicans have passed the only bill, while the Schumer Senate has been unable to…this could portend a major power shift if McCarthy can get close to his original proposal

- Democrats espouse a Keynesian framework arguing for more spending to drive aggregate demand and thus output and employment…hoping to avoid an economic slowdown before elections

- In our estimation, this amounts to income redistribution with the positive impact on beneficiaries largely offset by the cost of those paying the tab…disincentives are created via means testing of the social safety net…

- Incentives that are potentially created are important…for work, saving and investing…as government control of the economy increases the private sector is not incented to produce due to a weaker connection between effort and reward…slowing public sector expansion is bullish

- We like the fact that that Republican’s are pushing “workfare”, just as Clinton did…when welfare rolls subsequently declined by 50% and highest welfare cohorts declined the most

- Since then, under the guise of “temporary” actions, the government has reversed the workfare requirements

- In our view, as people join the labor force, they can increase their skills and earnings potential allowing them to escape the poverty traps that means income testing generates

- Workfare will increase the labor force, result in higher output, higher tax revenues and lower safety net participation which means lower non-discretionary spending

- Between Republicans refusal to raise taxes and “workfare” they can hope to undo some of the Biden’s administration’s policies which create disincentives to work, save and invest

Japan on the comeback trail after a few lost decades…?

- Japan’s Nikkei index broke thru 1991 levels (26,500) in late 2020 and eventually reached 30,000…then consolidated in a tight band and now making new highs at 31,000

- Japan’s domestic economy continues to reopen post Covid restrictions and investors have gained confidence in improved corporate governance measures

- Tokyo Stock Exchange appears to be focused on 1800+ companies chronically trading less than 1x Price/Book…including Toyota, Mitsubishi and Honda…no mandates but education and focus on capital efficiency is gaining awareness and presents a value creation opportunity

- Japanese company stock dividends have expanded sharply, while corporate buybacks YTD (March) hit a record $71.4 billion

- Japan is a beneficiary of “off-shoring” from China…memory-chip maker Micron Technology (MU) to build a $3.6 billion advanced memory plant, aided by Japanese government

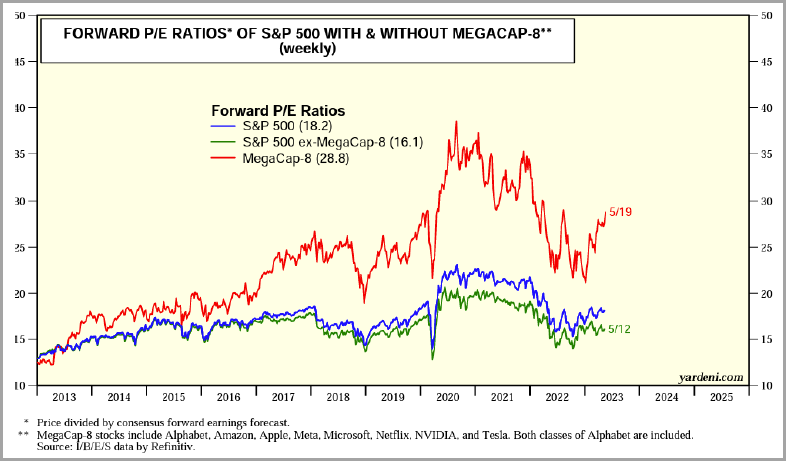

- Japan is still an export economy and leader in many brand name products including automobiles, semiconductors, consumer electronics and manufacturing equipment…

- Despite recent China related export weakness, exports in yen terms have risen 43% over the past two years to a record of more than $700 billion as of March ‘23

- Private consumption makes up 50% of GDP and is historically slow growing…March quarter grew 0.6% q/q aided by higher service spending and government travel subsidies…total GDP grew 1.6% annualized, still anemic…

- Private consumption is being buffeted by recent wage negotiations at the largest 300 companies which resulted in the biggest pay increase in three decades

- Bank of Japan (BOJ) has maintained its ultraloose policy and low interest rates (despite a falling yen) and rising inflation to ensure a sustained exit from deflationary forces of the past many years

- BOJ believes inflation will fall back to 2% over next twelve months and hopes to maintain such a level

- Japan, the 3rd largest economy in the world, has the highest amount of debt relative to GDP at ~ 300%…removal of the interest rate cap will result in increased interest expense and limited ability to further stimulus programs

- The BOJ has announced an 18 month long review of its monetary policy…too soon to know if it will seek phase out its massive stimulus plan…will most likely depend on

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Recent Comments