The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

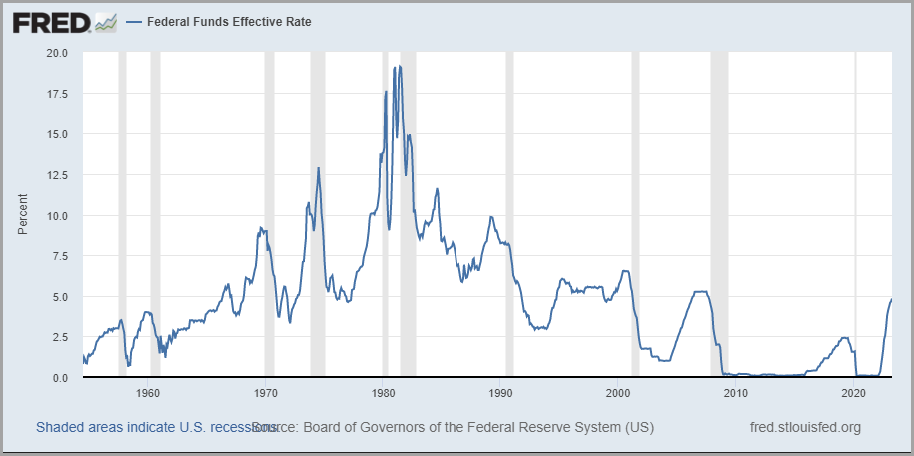

“Thank you sir, may I have another…?” Powell chimes in with 25 bps more…

- Not a surprise, the 5% Fed Funds threshold has been reached…now the question may be, does the 5% level mark the end of the cycle?

- Market participants certainly believe so with 63% and 95% seeing at least one cut before the July and September meetings…(CME Fedwatch tool)

- Yes, Powell has changed his language…just a bit…suggesting the Fed is in wait and watch mode going forward as opposed to prior meeting statements of definite future hikes

- No doubt his stance is the result of the 3 recent bank failures amid the fastest 500 bps Fed fund rate rise in history…credit contraction is likely to help him do his job…

- But Powell doesn’t believe recession is in the cards…and the S&P 500 is flat since the hikes began! Have we really whistled past the graveyard as flat ’23 over ’22 earnings suggest (Factset)…

- Or, have we yet to see the other side of policy “lag”, Fed balance sheet reduction and bank failure induced credit contraction creating a toxic brew for ’23 and ’24 earnings…

- We can only hope that Powell’s comments regarding recession avoidance are unlike comments he made that inflation is transitory and that the regional bank crisis is contained

- Inflation will continue to subside, even more now with credit restricted…the global supply chain index is in free fall…

- But labor markets haunt Powell as they continue to be robust which fuels the consumer driven economy – Powell is laser focused on the labor markets, weakness here has thus far been fleeting…

- Bottom line, market participants are out of step with the Fed’s plan…Powell believes he can keep the ghost of Arthur Burns far away while landing the Dreamliner U.S. economy on an aircraft carrier

- But market participants believe he has tightened too far and too fast and the wreckage can already be seen in the regional banks and will soon be evident in the general economy thereby forcing him to submit to their will and cut rates…time will tell who is right.

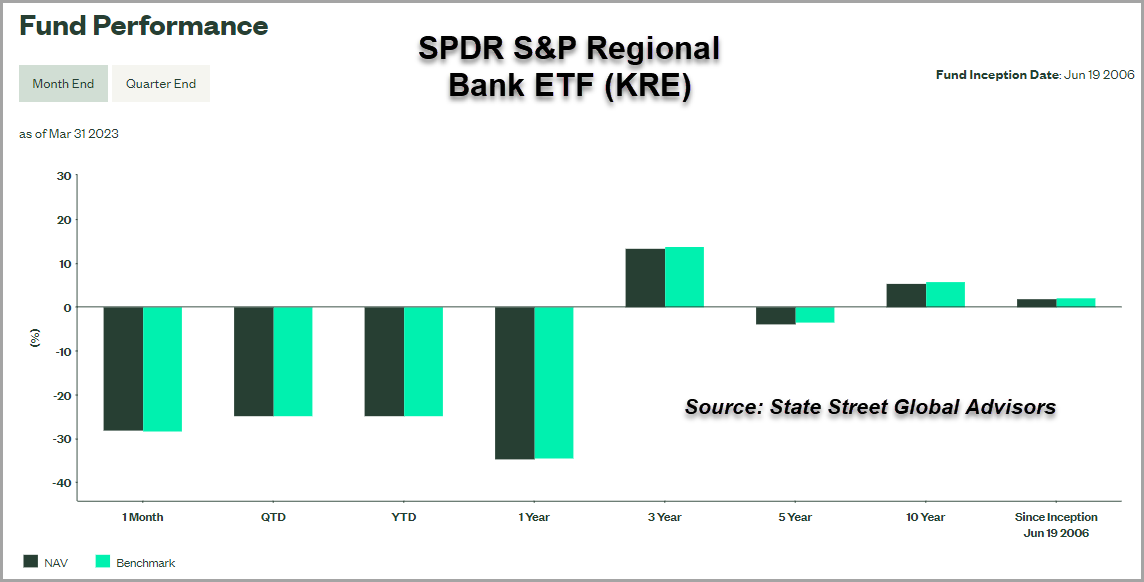

Regional Banks – wake me up from this nightmare…the KRE craters…

- Bank failures were supposed to be contained to idiosyncratic business models like SVB and FRC…high levels of uninsured deposits controlled by venture capitalists or wealthy individuals with an itchy trigger finger

- “Deposit beta” in search of higher returns was the initial driver…incented by regulation to own assets that subsequently dropped precipitously in price while investors were unwilling to support capital raises

- Business models were turned upside down from the quick and aggressive Fed rate hiking regime and risk management practices that were clearly secondary to profit maximization and common financial sense

- But WAL and PACW don’t look like SVB and FRC yet they are meeting the same fate…as are many others in the regional banking space

- Cries for greater regulation and a ban on short selling are increasing…but can that really stop the primary driver which is a loss of confidence in the U.S. banking system? Unlikely…

- Further regulation will be quite a ways down the road and is usually some part of the existing problem – i.e. creating financial incentives for banks to purchase government securities and overlook duration risk

- Shorts clearly have the upper hand and even the Financial Times is getting in on the act, perhaps unknowingly…per usual, when offered the opportunity they play their hand well…

- Powell seems oddly disinterested, blandly stating that the banking system is “sound and resilient”…as the next crop of regional banks are led to the chopping block an hour after his comments…

- Perhaps he doesn’t want to acknowledge that, in addition to poor company level risk management, his monetary policy has made it very difficult for banks to operate

- Perhaps he sees in the banking crisis a way to finally disrupt the labor market and satisfy his deepest Phillips curve desires to finally wrestle inflation down once and for all…

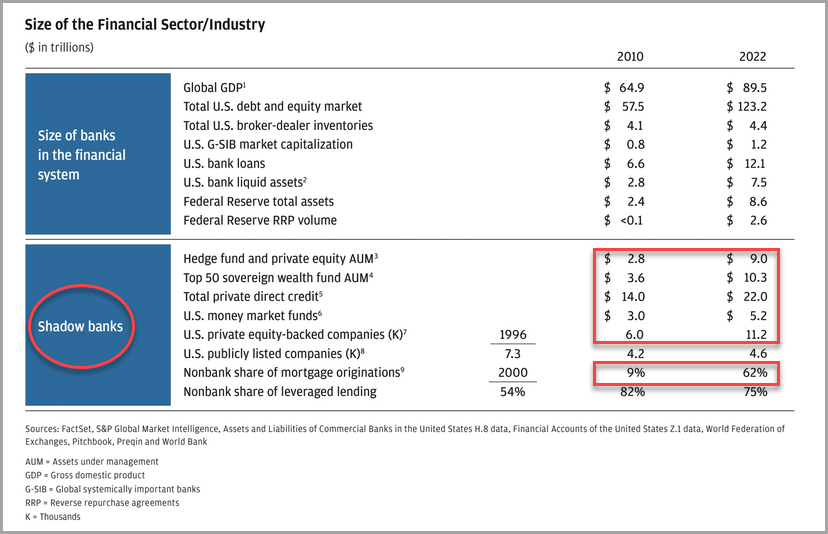

- The banking market is not so slowly shifting to the “shadow bankers” (see 2nd graphic in JPM section below) and recent activity will accelerate the brain and capital drain…is that a good thing?

- Current financial conditions will tighten though presently are remarkably sanguine, having slightly expanded in the past few weeks…SLOOP is due out next week although that will only reflect a few weeks of regional banking turmoil

- We are not optimistic that raising deposit limits will staunch a loss of confidence…a large majority of the banks under pressure don’t have a large % of deposits above the insurance cap

- Perhaps insuring “operational” accounts is one way to gain a small degree of confidence in the system and avoid bank runs above the $250K maximum

- Credit issues are only on the horizon at this point…a recession could bring them to the forefront including the much anticipated commercial real estate saga

- Regional banks are a necessary component of a functioning and strong economy…banking is a trust game and once lost it is tough to regain. We think banks will remain difficult investment vehicles in the short and medium term…we hope we are wrong.

- Some good weekend reading…Federal Reserve Board review of SVB; FDIC report on SBNY; GAO review of agency actions related to bank failures March 2023;

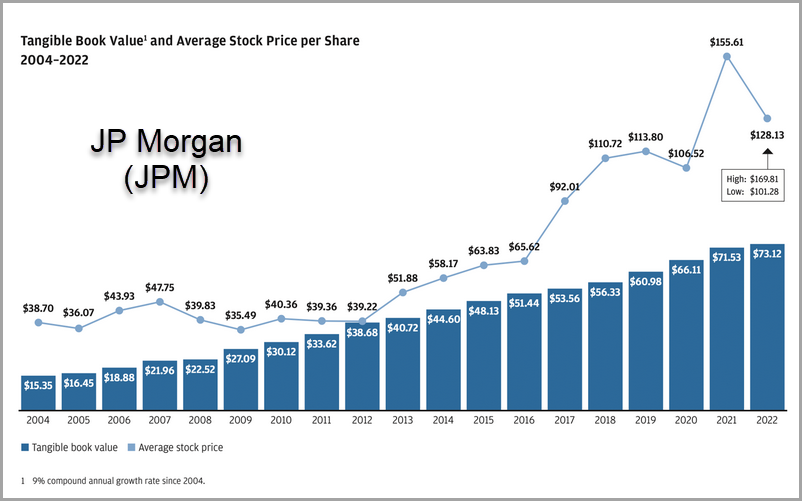

JPM comes to the rescue again…CEO Dimon on the banking crisis – “risks were hiding in plain sight”…

- For those that missed CEO Dimon’s annual letter, we recap it below…click here to read in full

- Risks in the banking system were hiding in plain sight…interest rate exposure, declining fair value of HTM portfolios and amount of uninsured deposits subject to flight

- For a few (SVB and FRC), corporate client deposits were tightly controlled by venture capital…and not nearly as sticky as believed

- Banks were incented to own “safe” government securities as they were highly liquid and had low capital requirements…duration risk be damned…

- Stress tests never incorporated interest rates at higher levels…how can that be? Even so, management should have known better and executed

- This is not a repeat of the GFC…in 2008, consumer mortgages soured and were owned globally in a levered system…far fewer issues to resolve today

- Deposits have flowed to larger banks but lack of trust in banks and U.S. financial system has/will damage all banks

- Need to take time to think through regulations and policy to avoid unintended consequences that have seen in the past

- Regional banks are essential to the American economic system and should be made stronger by any regulation(s)

- Large, complex banks also play a critical role in U.S. and global financial markets…they have the tools to manage complexity and scale

- Bank failures should be allowed to happen, via a prescribed process…need clarity and assurance on the unwinding process to ensure consumer confidence and reduce risk of a bank run

- Regulation goal should be to reduce the chance for bank failure as well as the risk of contagion

- Regulation can create a false sense of security…and create activity outside the regulated banking system…what are the ramifications of that?

- Banks need to be attractive investments…need clear and consistent regulations, real world stress tests and thresholds for mandated action

- Debate should be about optimal mix of regulations, not more or less, that will keep U.S. banking system the best in the world…

- Some credits or loans are better held in non-banks due to high levels of capital needed to be held against them

- JPM is constantly evaluating businesses – repricing, running off, changing client mix, resource optimization – good credit relationships require a lot of non-credit related revenues to drive profitability

- JPM is exploring new partnerships and perhaps more securitizations

- The mortgage business is expensive and complex…given capital requirements and lack of a securitization market it does not make sense to hold mortgages or servicing rights

- Continue to look for low/no capital revenue streams in data analytics or offer other services in consumer bank, wealth management and payment services businesses

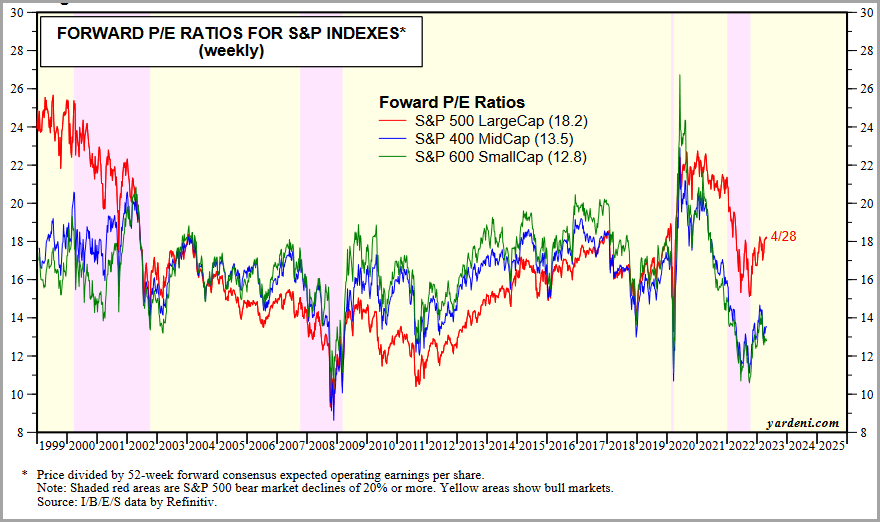

Small cap pain continues…just what the credit-reliant asset class didn’t need…

- Small caps (S&P 600) trade just 7% above pre-pandemic levels while the S&P 500 is trading 20% above…Micro-caps (Russell Micro-Cap) have broken below pre-pandemic levels

- As if small caps weren’t impaired enough from the thought of being the hardest hit asset class heading into a recession…

- Now they have to contend with regional bank Fear, Uncertainty, and Doubt (FUD) which threatens to restrict capital for expansion or at least make it far more expensive to operate

- Since SVB, the S&P 600 is down 11%…Financials make up 15% of the index and are down 30% representing almost half of the index decline…

- Financials should struggle to outperform as greater regulatory burden, increased capital requirements and slowing credit demand will negatively impact results…consolidation will continue but valuations will keep transactions subdued vs. expectations

- In our thinking, small caps will likely take their cue from their large cap brethren and seek to maximize liquidity via efficiency measures

- Of note, Industrials are the largest S&P 600 sector at 17%…they should be negatively impacted by a sluggish economy as expansion plans are put on hold in the quest for greater efficiency

- While credit spreads, which we typically think of as impacting small caps, have yet to widen owing to scant evidence of credit problems, a slowing economy could impair credits in the medium term

- While efficiency and capital maximization are to be applauded, in the presence of FUD it does not make for expanding valuation multiples

- Currently, small caps trade at approximately 13x forward estimates…certainly not demanding and in line with 2000 recession levels but 15% – 20% above 2008 recession levels

- Equity capital markets remain difficult and raising capital at depressed levels is not preferred from a dilution standpoint…but what needs to be done will be done, at the expense of shareholders

- We know that small caps are cheap…despite steady-ish credit spreads, FUD in the banking sector has and will continue to hurt the asset class

- We have lightened our weighting to the small cap asset space, despite their attractive valuations and will continue to evaluate both credit liquidity and durability

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Recent Comments