The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Fear not the Fed…stuck in neutral for many months is our opinion…

- The 6th FOMC meeting of 2023 should prove uneventful…CME FedWatch Tool at 99% probability of Fed funds staying at current 525 – 550 bps

- Looking further out, the market is falling in line with Fed’s tough talk as July ’24 is the first month where odds of a 25bps cut have increased over the past month

- The Fed continues to digest the data to assess the long and variable lag of monetary policy – rightly so in our opinion

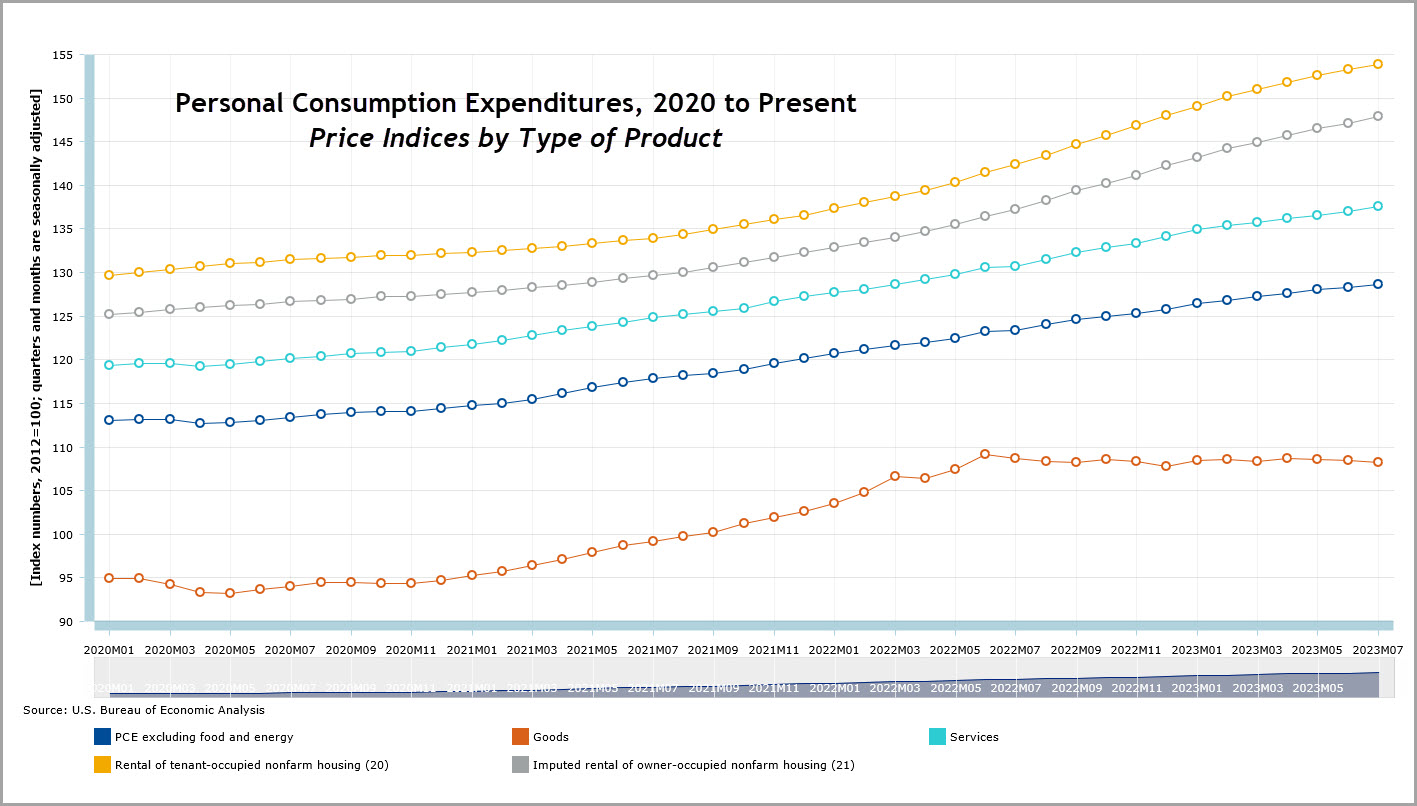

- Let’s not forget the most recent PCE data which is the Fed’s “go to” on the inflation front…

- The PCE price index increased .2% m/m and 3.3% y/y (chart above) which was a function of still hot services sector, up .4% m/m and 5.2% y/y…

- Services continues to be buoyed by Housing, both rental and OER, which increased by 7.8% y/y and together are 32% of the index

- Zillow Observed rental index latest data shows a 3.25% increase in August…median home prices of existing homes increased only 1.7% in July

- Thus, we expect continued improvement in the PCE and this is not lost on the Fed…

- Fed Governor Waller has said he wants to see more monthly readings like May, June and July (m/m .1, .2 and .2)…PCE m/m readings in Aug/Sept/Oct of ’22 were .3%, .3% and .4%…

- Money supply growth continues negative for the first time going back to 1960 as the Fed drains liquidity from the system

- As we move into an election year, will the Fed be pressured to back off their draining of liquidity?

- We do not expect the Fed to change its inflation target…Powell knows he made this mess and he is determined to clean it up…it’s his legacy after all…

- Movement toward the 2% target will come slowly, but it will come…higher for longer indeed…

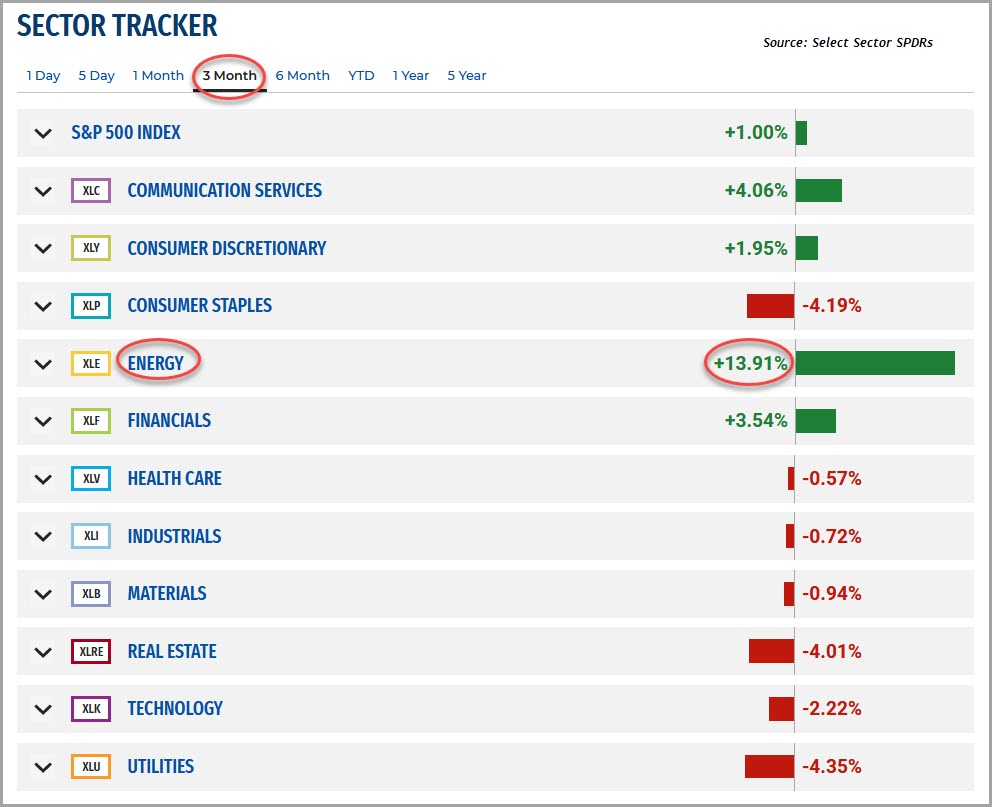

Energy sector having another day in the sun…OPEC+ holds the key to more gains

- Production cuts announced by OPEC+ in November ’22 had only a temporary impact on oil prices as concerns over China and global growth weighed on estimates of global demand

- Further production cuts in July, recently extended through ’23, have since catalyzed the XLE…at the same time as global growth estimates have rebounded

- OPEC has now cut ~ 2.5 million bpd from the market since the start of ’23…with the IEA Oil Market Report estimating a supply shortfall through year end ’23…

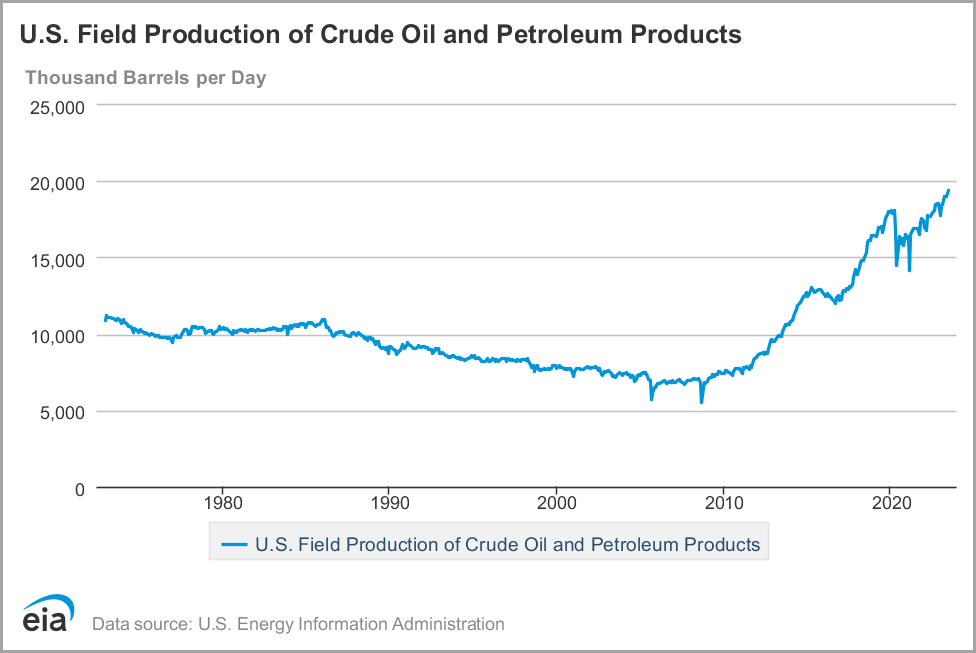

- Cuts by OPEC+ (including Russia) have been somewhat offset by Non-Opec growth of 1.5 million bpd led by the U.S., Iran and Brazil…

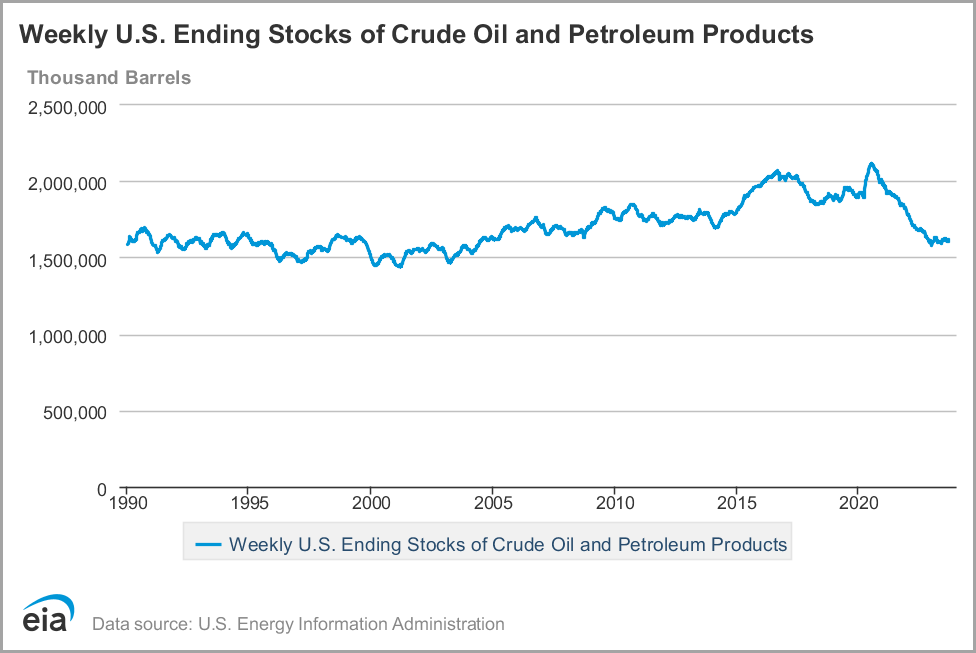

- Resulting in global oil inventories plummeting to a 13-month low…with China showing the largest draws

- Brent, WTI and the OPEC basket price now all trade comfortably above $90…compared to lows of $70 in late June

- How does the price vs. volume tradeoff net out? The IEA estimates that Russian oil export revenues surged by $1.8B to $17.1B in August owing to higher prices despite lower shipments…

- U.S. crude oil production is back to pre-pandemic levels…including liquids, the U.S. is producing 8% more than Feb ’20…U.S. crude stocks are at multi-decade lows (above)

- The ending stock of crude oil in the SPR is at lows not seen since the mid-‘80’s and represents ~ 1 month of U.S. crude oil production to return to longer term averages

- All of the above should set up an outstanding environment for domestic producers as well as oil service companies…

- Yet energy companies are facing elevated prices from a year ago and thus CY2023 earnings are expected to decline by the largest amount, -30%, of all eleven S&P sectors (Factset)

- Looking into 2024, Energy earnings growth is expected to be the lowest among the 11 S&P sectors at 2% (Factset)…

- What level of oil prices analysts have baked into estimates is a question…given the recent quick rise in crude prices, it is likely correct to assume that current estimates are quite conservative

- Valuations for both the producers and oil service providers do not appear challenging relative to historical levels…with the producers more attractively priced relative to history…

- But valuation is also a reflection of earnings predictability…and thus OPEC+ holds the key to near and medium term stock prices…

- Our bet is that prices stay higher for longer…OPEC+ will be cognizant of not pushing prices so high as to negatively impact global growth

__________________________________________________________________________________________________________________________________________________________________

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Recent Comments