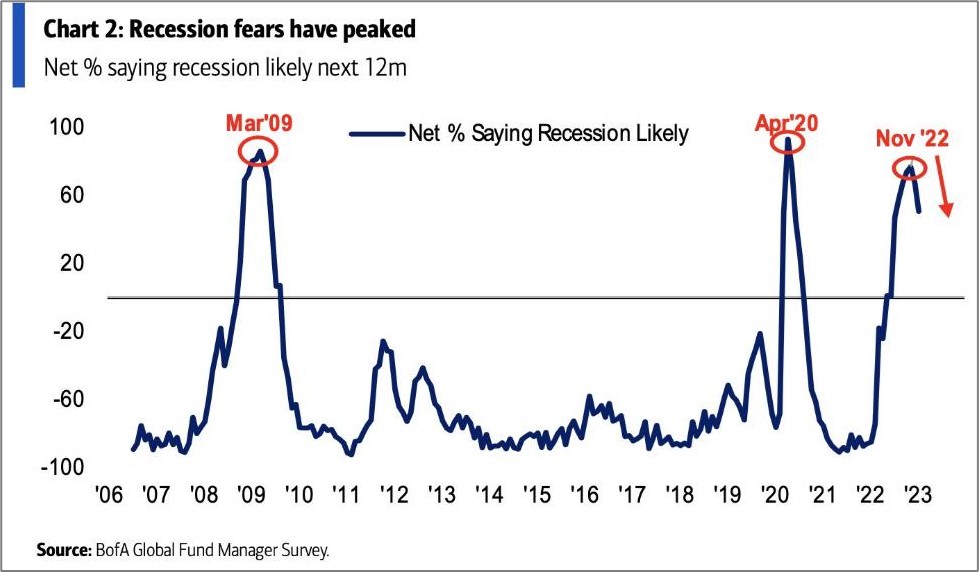

It is hard to believe that 2023 is now halfway over and the big macro worries which we began the year contending with, still remain on the forefront of many investor’s minds. On the back of terrible market performance in 2022, investors started the year fixated on inflation, Fed policy and a potential recession. In fact, 65% of investors felt that a recession was inevitable in 2023 including several notable well respected, typical bull market proponents.

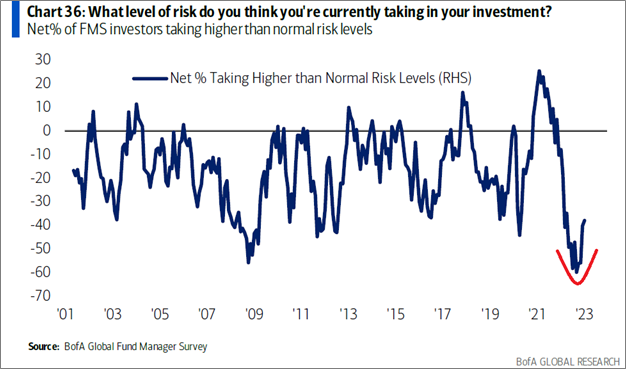

Everyone had thrown in the towel and investor positioning reflected it. Of 20 Wall Street investment strategists, only 2 had bullish forecasts going into 2023. According to a January 2023 Bank of America Global Fund Manager Survey, investors were overweight cash and alternatives and dramatically underweight stocks. The odds that the market could shake off the well known worries and rally meaningfully were highly discounted.

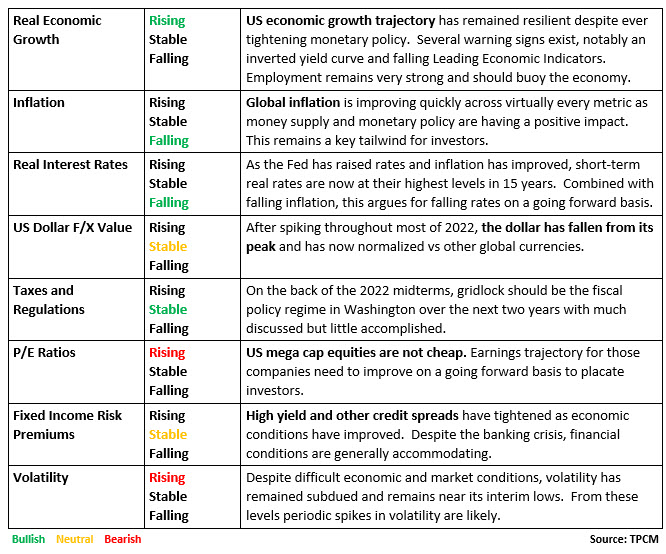

Yet as is often the case, consensus proved to be too one sided and thus far both the economy and the market have outperformed virtually everyone’s early 2023 expectations. Not without volatility and dispersion but the S&P 500 has risen an impressive 15% over the first half of this year. TPCM began the year with a more constructive outlook which centered on improving inflation as the key variable to investment market improvement. We have long viewed the dramatic decline of the monetary base as the precursor to falling inflation and have not been surprised by the improvement in price indices. We have also not been surprised by the resilience of the economy as employment and consumer spending have remained strong. What has been a surprise is the Fed’s insistence to continue to raise rates and forecast further hikes despite the dramatic decline in inflation. In our opinion, inflation should approach the Fed’s 2% target by the end of 2023, yet Fed Chairman Powell continues to talk about more rate increases. Given that, the real interest rate on the US Treasury 2 year note is at its highest level in 15 years reflecting tight monetary policy and is a risk to be monitored.

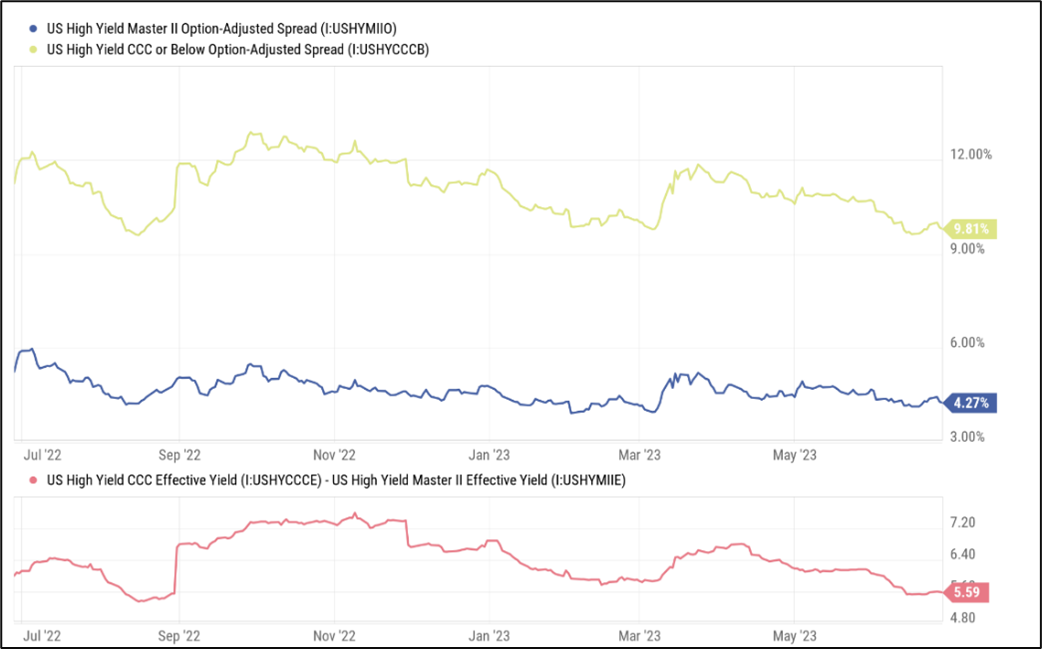

As we enter the second half of this year, our fundamental market viewpoint continues to be constructive as we expect further inflation improvement to be a key driver and remain confident that the US economy will avoid a slowdown throughout the remainder of the year. Despite storm clouds on the horizon in the form of an inverted yield curve and falling LEI’s, the economy has chugged along owing to a still buoyant consumer and risk measures such as high yield and other credit spreads have yet to signal investors hitting the risk off button. Volatility measures have been remarkably subdued no doubt reflecting the slow but consistent rise in market indices.

2023 3Q Key Economic and Investment Drivers

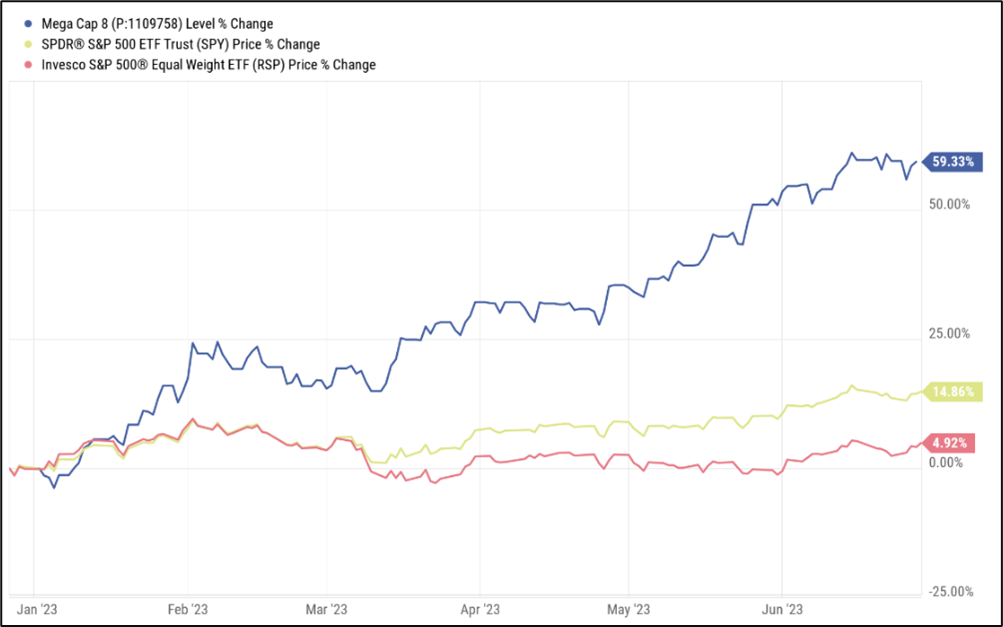

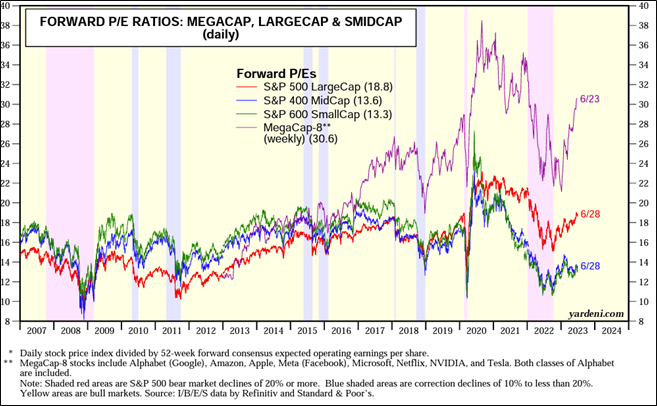

While returns for markets were quite strong over the first half of 2023, with the S&P 500 up over 16%, there was much dispersion among stocks. Mega cap growth and artificial intelligence related stocks posted extraordinarily strong returns yet other equity types including dividend, value and smaller capitalization stocks underperformed sharply. Factors that were out of favor in 2022, namely quality and momentum, suddenly became vogue again. The disparity in performance between the Equal Weighted S&P 500 relative to its Market Cap weighted sibling, almost 1000 basis points, was the largest since 20009. Of note, on a YTD basis, the eight largest companies of the S&P 500 posted a 60% weighted return whereas the “average” company in the index posted just about a 5% return. And, as has been well chronicled, the eight largest stock represent the lion’s share of YTD gains for the S&P 500. Thus far in 2023, investors have been whipsawed by the under currents in the market leaving them frustrated despite the strong posted returns.

Bears have viewed the poor market breadth as another worry, and we do recognize this as a risk. Yet, this risk is also an opportunity as the valuation spread is as large as the performance spread has been. If someone says, “the market is rich” one needs to ask “what market?”. Mega Cap…. yes, very rich. The entire S&P 500…. a bit pricey. Everything else…not so much and if we had to bet it is this group of laggards where the best returns will lie in 2H23.

Beyond equities, the bond market has posted solid returns so far in 2023 despite continued rate increases by the Fed. Quite a reversal from 2022. Corporate credit in particular has performed well as high yield bonds are up about 4% for the year. Importantly, credit spreads give us a view into the performance of corporate bonds but also the health of the lending markets. Between tightening monetary policy and the (brief) banking crisis which occurred in March, many thought that credit markets would tighten and lending would be cut off to corporate America. Small cap stocks, in particular, were hit hard during March because of that concern. Yet while banks have definitively tightened their lending standards, overall credit conditions remain constructive. In fact, high yield spreads continue to narrow as economic fundamentals improve with the greatest tightening occurring among the most speculative credits.

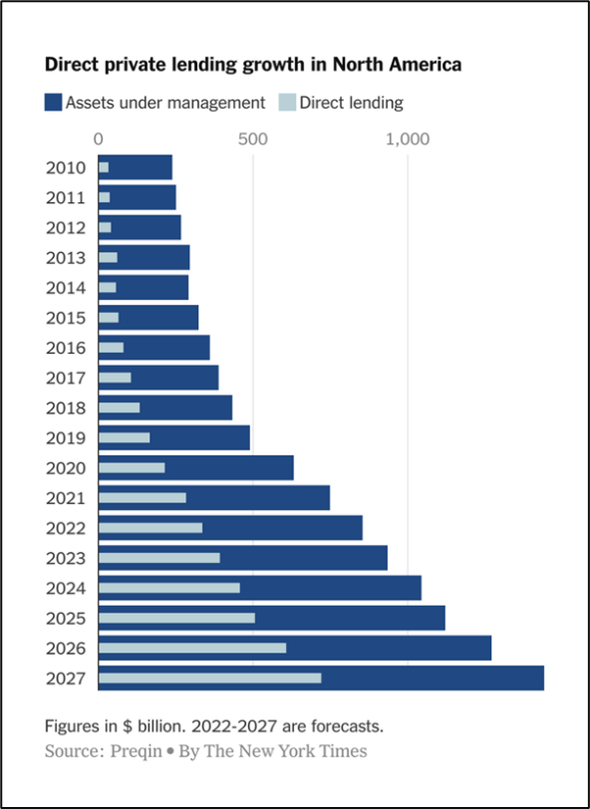

Additionally, as banks have pulled back, the shadow banking market continues to grow. Non-bank financial institutions such as private credit funds, hedge funds and direct lenders continue to grow and represent a larger portion of the credit marketplace. From a macro-economic perspective, we think that is a good thing particularly given the fragility of smaller, regional banks. While we don’t believe that smaller banks will be entirely replaced by shadow banks or through bank consolidation, we do believe that a broader, more diverse pool of credit sourcing provides benefits to borrowers and the economy, as a whole.

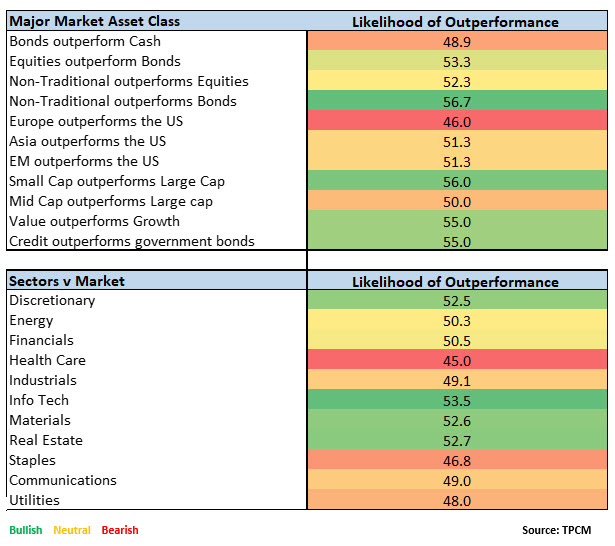

As we enter the third quarter our viewpoint on markets remains constructive. As indicated above, the fundamental drivers to this optimistic viewpoint are a positive outlook on economic activity, continued improving inflation metrics and diminished headwinds from monetary policy. We expect both equities and non traditional assets to outperform bonds and see value down the market cap spectrum. From a sector standpoint, with a still resilient economy we want to maintain exposure to the more cyclical elements of the market, namely Consumer Discretionary and Technology, while also acknowledging that there are opportunities in under performing sectors. This would include the REIT’s, a diverse group, that has largely been painted by a broad brush from investors wishing to avoid commercial real estate exposure. Yes, rising rates provide competition for these yield assets but we are diligent in looking for opportunities in various sectors and names of the REIT universe.

Thus, going into 3Q23, we will remain fully invested in equities, subject to client risk parameters, but will rotate some monies out of large cap growth-oriented investments into smaller capitalization stocks. We’ll also add a value tilt to the portfolios reflecting our concern for valuation in growth companies. As noted above, cyclical sectors and names continue to be favored at the expense of defensive where we hope to be opportunistic. If the outperformance of large cap growth wanes, the environment for stock picking should improve. Active managers struggled in 2Q23 as owning enough Tech and AI related names to keep up with the market proved difficult for most. A rotation away from large cap should benefit active managers. Our overweight to international markets will be reduced as the forward economic growth trajectory appears better in the US than overseas. The long awaited China re-opening appears to have stalled again hindering the outlook in Emerging Markets and other foreign economies.

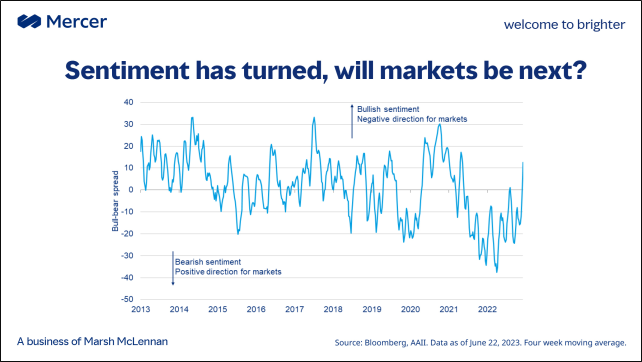

Our viewpoint going into 2023 was contrarian as most market participants were flat out bearish. Going into the second half, we have a more consensus view as overall market sentiment has become more bullish. The VIX is at secular lows reflecting complacency among investors. This is definitely a risk to be monitored, and as indicated by Mercer Consultants, sentiment readings have recently improved from extreme bearish levels potentially reducing one pillar for continued market gains.

However, the bottom line is what investors are actually doing with their money. Despite more “bullish” sentiment, institutional investor positioning as reflected in Bank of America’s Global Fund Manager Survey, remains defensive with cash allocations still historically high and equity allocations still remarkably low.

It is this positioning data, in conjunction with our expectation for continued improving economic fundamentals, which we believe will continue to propel markets higher. Risks always remain and a monetary policy mistake by an overly restrictive Fed remains at the forefront of our list of concerns. Overall, however, we believe that the market will continue to climb a wall of worry and that investors will be compensated for taking investment risk over the remainder of 2023. So, to answer our own question…no, it is not over yet as we expect both equity and fixed income market to continue their rise as investor’s worst fears are not realized.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments