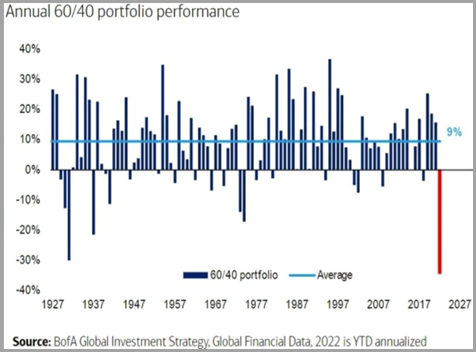

With greater than 60 days of 1% declines in the S&P 500, 2022 was truly a year of heartache for investors who had become increasingly comfortable with an ongoing love affair with the market over the past 10+ years. Coupled with record setting declines in bond prices, the frustration of investors has been echoed throughout the financial community and we won’t spend too much time belaboring it. As multi-asset investors, we rely primarily on the natural hedge that various asset classes provide to one another when we construct portfolios. That proved to be quite a futile endeavor this past year. The 60/40 portfolio is the best broad proxy for multi-asset investing and, according to Bank of America, 2022 was the worst year for balanced fund returns in 100 years. As Bonnie Tyler crooned in the song titling this missive, “Love him ’til your arms break then he lets you down.” In 2022, investors were starkly reminded of what it’s like to be spurned by a market that has treated them so well for so long…

But all is not doom and gloom. Recently, our clear eyed economist Victor Canto wrote a detailed and very worthwhile piece examining the long term history of a 60/40 portfolio return. Victor notes that 2022 was an outlier, a black swan event no less, yet he details the historical benefits of a balanced portfolio over various economic and market regimes and concludes that the balanced strategy should continue to have utility for most investors. Despite the current negativity around multi-asset investing, we continue to believe in its long-term merits and continue to advocate it for most of our clients. Call us hopeless romantics perhaps…

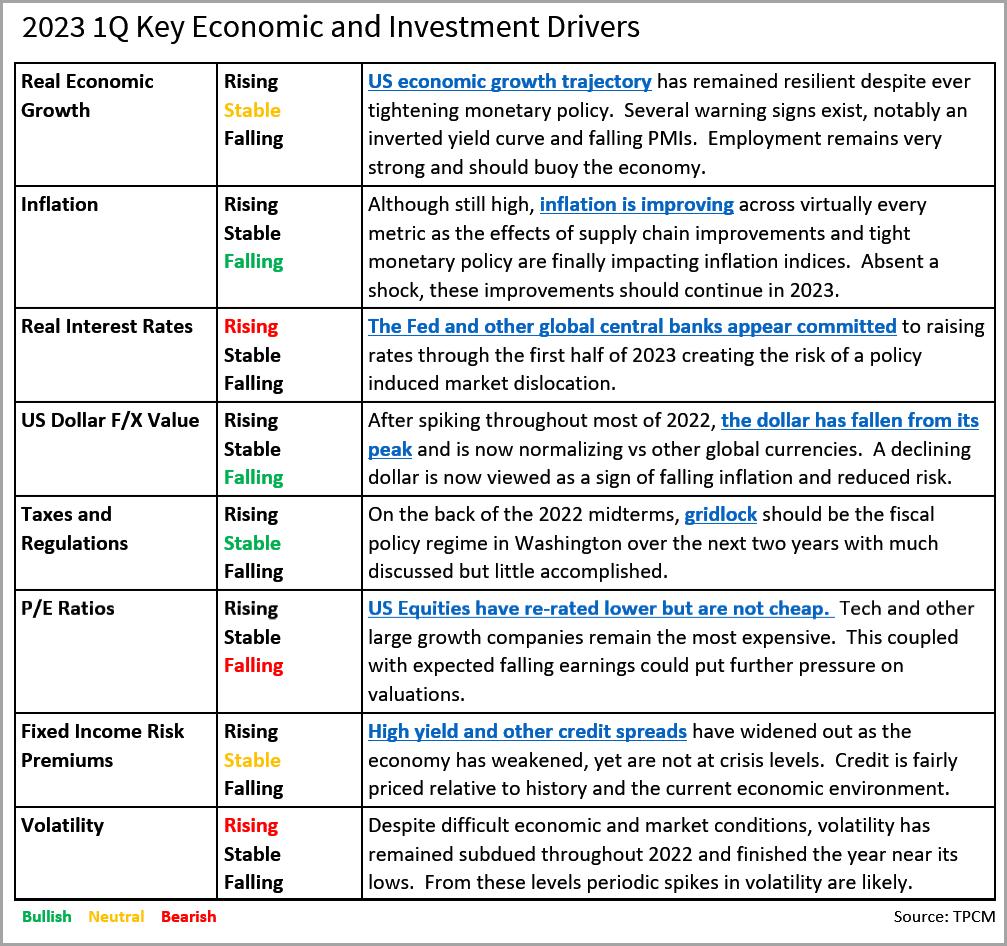

An extension of the negativity over both fixed income and equity returns is the pessimism around the economic trajectory in the US. Concerns over continued inflation, continued monetary policy tightening and a pending economic slowdown are pervasive. BlackRock, for example, recently published their 2023 outlook which was quite negative, forecasting continued high inflation and tight monetary policy which will push the US into a meaningful recession into the next year. By contrast, our viewpoint is more constructive, and, in addition to hopeless romantic, you can put us squarely in the soft landing category as we continue to see signs of improvement in inflation and resilience across the economic landscape.

Without a doubt, risks persist, of which the greatest remains monetary policy risk. While this topic has been hashed out across the financial media at length, it is still worth noting. Historically, periods of aggressive monetary tightening have often caused market dislocations – see 1994, 1998, 2001 and 2018 – and that risk remains. Will the current tightening regime induce a recession as most investors seem to believe or will it be something more akin to the emerging market debt crisis of 1994? Or perhaps we’ve already had our crisis with the bond market down 13% in a year. Time will tell. Yet we do believe that monetary policy, as disruptive as it has been, is well discounted going into 2023 and will unlikely surprise anyone again this year.

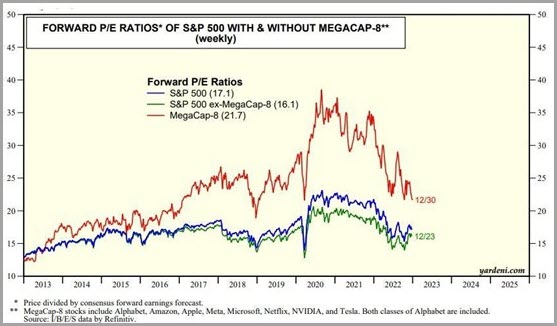

As discussed above, valuations of US equity investments are far from cheap and that too remains a risk. Specifically, the mega cap darlings, trading at a 25% premium to the S&P 500, are now in focus. December was a disaster for these stocks as investors have entirely soured on their prospects relative to their valuation. See TSLA. Given the economic uncertainty and the expectation that earnings forecasts will continue to fall, valuation is now an important consideration and selloffs in the mega caps could continue to drag down overall market performance.

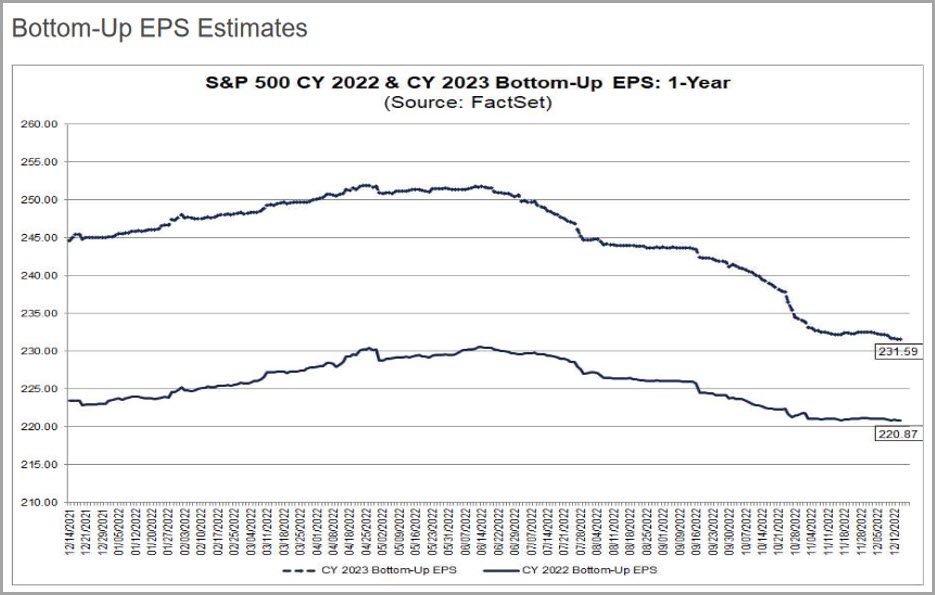

To be sure, analysts are waking up to the risk of earnings shortfalls as the forward 12-month S&P 500 eps estimate has declined from $250 in August ’22 to a current $230 (Factset). Granted, that is still anticipating eps growth of 5% in 2023 despite the fact that 4Q22 earnings are now expected to show the first quarterly decline (-2.8%) since 3Q20. For perspective, 2019 (pre-pandemic) S&P 500 earnings were $163. Fed commentary suggesting a sustained inflation fighting effort could put this rosy earnings outlook at risk, and we are watching the employment market closely, and more specifically, the trajectory of wages. Chairman Powell has clearly linked wages to the ascent of non-housing services in the PCE, which appear to be the holdouts on price declines, as far as the Fed is concerned. This could be the tell for “how long, how strong” Fed action may be, which market participants are dying to know the answer to….

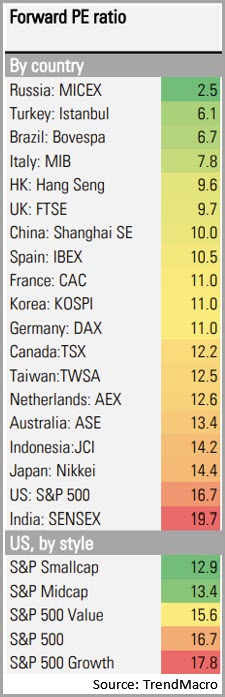

In the case of valuations, this risk may also be an opportunity. US large cap growth stocks have sharply outperformed the market over the past dozen years. Correspondingly, when looking away from US large cap stocks, the valuation story is not so frightening. In the United States, small and mid-cap stocks are trading at meaningful discounts to large caps and appear to have fully factored in a domestic economic slowdown. When looking at current forward p/e ratios, SMID caps are trading at roughly 13x whereas large caps are trading at 17x.

More so when looking overseas, the valuation discrepancy is even greater, where non-US stocks are trading at 12x, on a forward basis, with several markets trading at miniscule valuations relative to the US.

International equity markets have broadly underperformed the US for over 10 years, mostly for good reasons. Economic policies and corporate governance have been relatively poor which has resulted in lower economic growth and profitability. In as much as overseas markets are also struggling with a new monetary policy regime, as the era of ZIRP is now over, rising rates may continue to bolster local currencies at the expense of the dollar giving international markets a much needed tailwind. China has been a wildcard for the past several years and COVID uncertainty remains. Yet that too may be changing.

Given the valuation discount, coupled with a declining dollar and a potential re-opening in China, foreign markets are beginning to look more attractive and should justify greater allocations.

Ever since the financial crisis, private equity and debt markets have grown rapidly as investors of all types have been attracted to higher potential returns with less indicated volatility than public market stocks or bonds. Yet funds which invest in privates are not devoid of risk. Just as public market valuations have fallen, so too will private valuations. According to Bloomberg, private equity deal activity was down 46% in 2022 which will have an impact on marks and valuations. The risk lies if investors lose faith in these illiquid assets and redemptions begin to exceed net cash held in funds, causing a proverbial run on the bank.

Recently, a private real estate fund run by Blackstone gated investor redemptions despite strong stated returns. Unusual but not entirely surprising given what has been going on in commercial real estate. On a standalone basis, this is not a big issue. Yet leverage and illiquidity can be a fatally bad combination and could have an impact well beyond the fund itself. See Long Term Capital Management, circa 1998. We remain advocates for private investments yet, just like their mega-cap public brethren, here too the valuation gap grew wide and we believe not all the risks have been fully discounted in the private space. We expect to hear more on “down rounds” being completed and “restructurings” which could severely impact fund valuations.

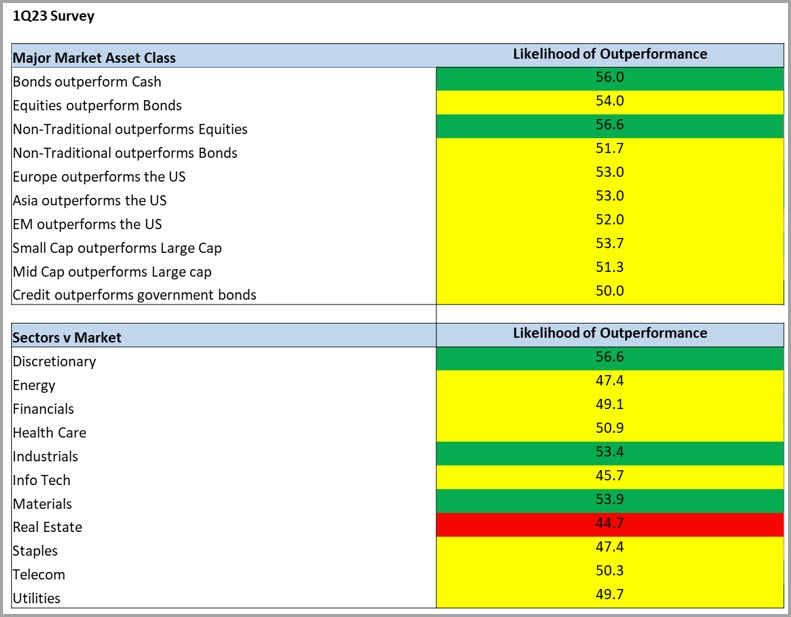

Despite our noted concerns, our outlook for markets is not entirely bearish and our model has mostly neutral viewpoints across asset classes and sectors. One important change is an improved outlook on international markets leading to overweights overseas for the first time in many years.

Granted, much of our outlook is contingent on our belief that inflation will improve and the US will avoid a meaningful economic slowdown. In essence, we agree that the magnitude of the down move in both equities and fixed income in 2022 was a black swan event but that given our current fundamental outlook, investors have a greater likelihood of being fairly compensated for taking risk in 2023. Can a 1 in 300 event happen two years in a row? Sure it can, but heartache hurts the worst when it comes out the blue. With all the acknowledged negatives in the market, it wouldn’t surprise us if the pain of heartache soon subsides and investors find themselves with renewed optimism for a brighter future.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments