It goes without saying that 2022 was a difficult investing year and the list of items to worry about seemed never ending. The biggest worries on the list were inflation, Fed policy, the inverted yield curve and a recession (which has yet to come). The first quarter of 2023 proved to be much improved from a stock and bond market performance standpoint as markets recovered from depressed December lows. Yet seemingly, the worry list for investors continued to grow.

To combat inflation, the Fed adopted a “Higher for Longer” interest rate prescription, and over the last six months things appeared to be improving. Inflation was falling and pro-cyclical asset classes and sectors tended to outperform….high yield had outperformed high grade bonds, small cap stocks had outperformed large cap, cyclical sectors outperformed defensives. Seemingly a goldilocks outcome. Yet, to many, “Higher for Longer” really meant “Raise until Something Breaks” and during March, the break occurred with capital flight from smaller and regional banks and the collapse of Silicon Valley and Signature Banks. Rapidly, the concern for investors shifted from inflation to recession and a flight to quality rally was sparked. Treasuries, defensive sectors and large cap tech all posted big gains while virtually everything else sold off. Somewhat ironically, 60/40 portfolios, counted out for dead just three months ago, posted nearly 6% gains for the quarter. Yet it is the increasing concern over banks and banks’ lending capabilities leading investors to believe (yet again) that a recession is imminent.

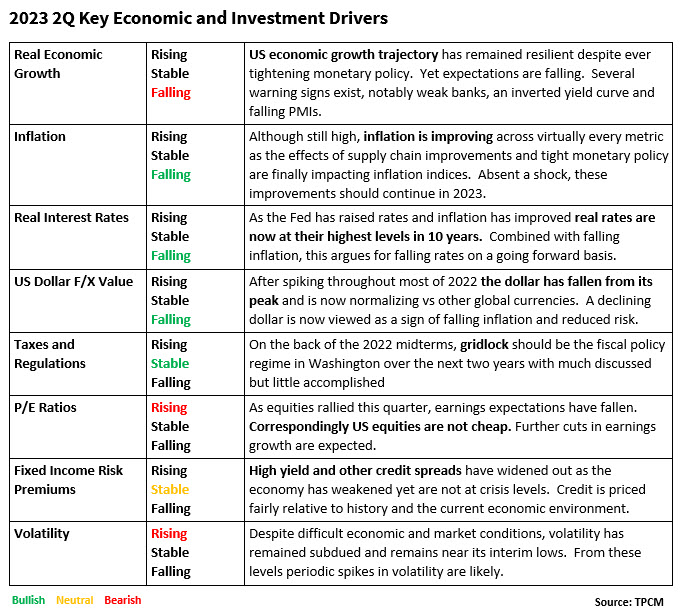

As we enter the second quarter, recession risk remains the big question, yet other variables point to a more constructive viewpoint, particularly around inflation and interest rates.

We have long taken the view that inflation has been the key problem and as inflation improves so will market sentiment and market returns. That proved to be true over the first quarter and we continue to believe it will be true going forward. Yet we do worry that the Fed may have gone too far, and that policy may not shift quickly enough to offset the growing list of economic growth risks. Banks, real estate, corporate earnings are all fragile and point to growing economic weakness. Employment has remained very strong but to some, that is the next shoe to drop. Beyond our fundamental view, the stock and bond markets are also telling us to be careful as the rapid shift to risk off investments needs to be considered when constructing portfolios going into the second quarter.

Overall, we are not entirely pessimistic about forward-looking market returns as we believe fundamentals are constructive but do believe that positioning within portfolios should change to reflect rising risks. While we will remain fully invested in client portfolios going into the second quarter, we will reduce exposure to small and mid-cap stocks in favor larger capitalization stocks. As lending from banks may dry up until the banking crisis passes, capital starved small caps stocks could underperform. A falling dollar as well as a long awaited re-opening in China lead us to greater allocations in non-US equities and in emerging markets, in particular. EM equities have underperformed US equities sharply over the past 10 years and are quite cheap trading at roughly 11x forward earnings. China in particular trades at 10x with an improved economic growth trajectory. Among sectors, pro-cyclicals are less attractive, and defensives are marginally more attractive. Real estate remains fundamentally and technically problematic.

Opportunities within fixed income have not been better over the last several years. As mentioned earlier, real interest rates are at 10-year highs and credit spreads remain full. This provides investors with a wide range of options across many fixed income investment types. Despite concerns over a slowing economy, credit sectors such as high yield continue to look attractive to us. Defaults remain extraordinarily low, interest coverage ratios are at 20-year highs and refinancing risks are very low. We continue to favor high yield as an attractive “tweener” asset class. After posting double digit negative returns in 2022, broad bond indices are up 3% year to date. If inflation continues to improve investors should continue to reap strong risk adjusted returns throughout 2023.

Among other things, we remain convinced that the news cycle will keep investors on their toes throughout 2023. Beyond the broad economic trajectory, resolution of the banking crisis will create volatility as will debt ceiling negotiations between the White House and Congress later this year. Yet, we are already on a dramatically improved economic and investment path in 2023 than 2022. Additionally, with further improvements in inflation, other risks variables will likely diminish and investors will likely receive adequate compensation for taking risks throughout the balance of 2023.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments