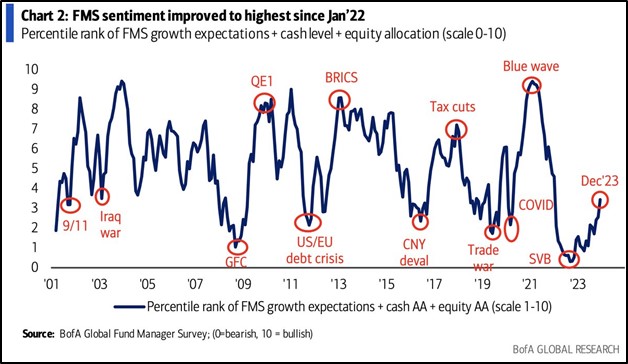

Despite a steady drumbeat of negativity from the financial media and the investment community throughout the year, 2023 proved to be an extraordinarily good time for markets in the United States. Following a terrible 2022, investors began the year exhausted, and sentiment hit rock bottom levels. The financial media continued to point out the debilitating effects of high inflation and tightening monetary policy. Not only were early 2023 calls for a recession widespread, the calls were for an imminent, destructive economic downturn where both bonds and stocks would continue their fall from 2022. Yet as we now clearly know, those recession calls were patently wrong as the US economy and markets proved (again) to be quite resilient. Our viewpoint from this time last year and throughout 2023 was generally more balanced and constructive as we believed that inflation had peaked and the impacts of monetary policy would diminish over time. That fundamental viewpoint proved to be generally true, and we now stand at a point where investor sentiment and positioning has shifted quite quickly to the positive.

It is not entirely surprising to us that sentiment often follows market direction and that investors are now becoming more confident. Yet do forward looking fundamentals support this newfound bullishness? Overall, we do believe that fundamentally the US economy remains in good shape. Again, real GDP growth should remain solid, albeit growing at a slower pace than we experienced over the past few quarters and inflation should additionally continue its decline but also at a slower pace.

1Q24 Economic and Investment Drivers

| DRIVER | STATUS | COMMENTARY | |

|---|---|---|---|

| Real Economic Growth | Stable | U.S. economic growth trajectory has remained resilient despite ever tightening monetary policy. Yet growth expectations are falling from lofty levels. Employment trends are not quite as positive as earlier in 2023. | |

| Inflation | Falling | Over the past year, inflation has improved across virtually every metric and now is approaching the Fed's target of 2% Core PCE. Improvements should continue, yet future declines will be less pronounced. | |

| Real Interest Rates | Falling | Due to Fed rate increases and improving inflation, real interest rates are at high levels. Slowing growth combined with future falling inflation argues for falling real rates, on a going forward basis. | |

| US Dollar F/X Value | Falling | The dollar has remained the king currency among global competitors yet concerns over deficit and falling rates in the US may take some of the momentum away from the greenback. | |

| Taxes & Regulations | Rising | Since passing the Fiscal Responsibility Act in May, D.C. politicians have added $1 trillion to the Federal Debt. The Biden Administration is looking to implement additional taxes to offset spending. | |

| P/E Ratios | Stable | S&P 500 earnings have rebounded from early 2023 lows and now are near cycle highs. Further increases will likely moderate and valuations remain full. Small caps, international and other market segments trade at meaningful discounts. | |

| Fixed Income Risk Premium | Stable | High yield spreads have tightened throughout 2023 reflecting overall economic resilience and strong corporate balance sheets, closing at the tights of the year. We expect spreads to remain narrow. | |

| Volatility | Stable | Volatility has reached cycle lows as both the economic and market environment has exceeded earlier expectations. Periodic spikes are always a risk. | |

| Source: TPCM | Bullish | Neutral | Bearish |

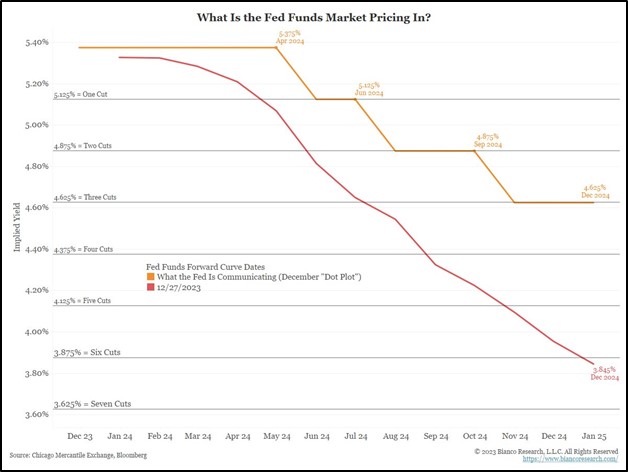

Among the items which the market seems to be most hopeful about is the prospect of a change in monetary policy, where the Fed begins an easing cycle. In fact, the market currently believes that starting in March the Fed will cut rates six times in 2024 with a year-end Fed Funds target of less than 4%. Just three short months ago, the bond market was in disarray and investor expectations for rates were quite negative. We too, believe that real rates remain too high, and inflation will continue to improve but six cuts is quite a high hurdle and current expectations for the Fed may ultimately be too optimistic. Yet we are encouraged that the Fed and monetary policy will be a less important factor for investors in the coming year.

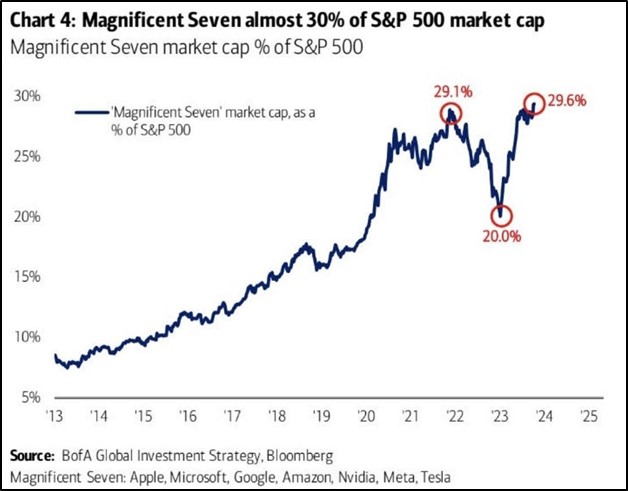

In hindsight, falling inflation, strong economic growth and improving earnings are a recipe for outsized equity market performance, so last year’s 25% increase in the S&P 500 doesn’t seem so outlandish. Yet, the concentration effect of the market returns was extraordinary with the Magnificent Seven (M7) of the S&P 500 (AAPL, MSFT, GOOGL, AMZN, NVDA, TSLA, META) leading the market, posting a weighted return of roughly 90%! Whereas the equally weighted S&P 500 rose a much more modest 11.7% and small cap stocks rose 15%, most of which occurred in the fourth quarter.

Given this historic return anomaly, valuations and relative weightings between the M7 and other equity components have become quite stretched. Currently M7 represents nearly 30% of the S&P 500’s market cap and 17% of the MSCI AC World Index. M7 trades at a forward multiple of 28x earnings whereas the remainder of the S&P trades at a 17x multiple.

So, entering 2024 equity investors will have to make very active decisions around holding M7 equities and to what degree. M7 bulls contend that the long-term growth potential of these companies exceed much else available among global equities. We generally agree that these world class brands have meaningful potential, but do current market valuations fully reflect that? From our perspective, we believe that optimism around the M7 has reached a fevered pitch and that several of the M7 companies have unique challenges. For example, Apple no longer has the earnings growth characteristics it once exhibited. Furthermore, we are encouraged by the broadening of market returns over the fourth quarter and believe that trend may continue throughout 2024.

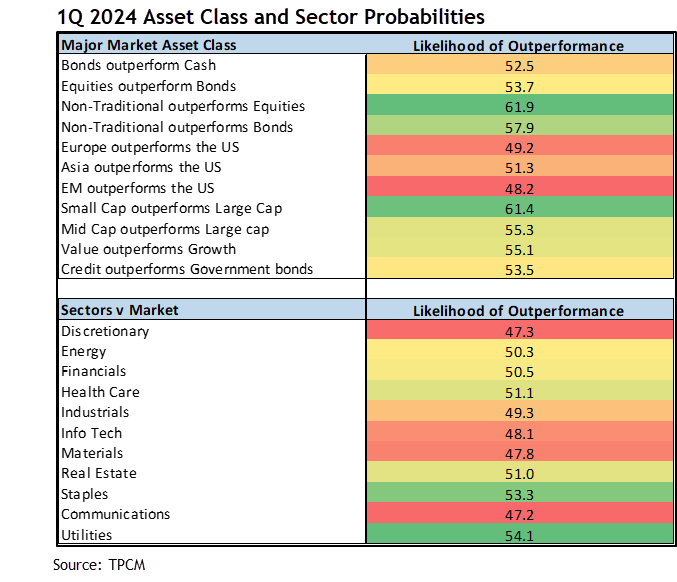

Consistent with our fundamental viewpoint, our first quarter probability assessment of relative market opportunities remains optimistic towards equities and other risk assets, thus we will overweight stocks relative to bonds broadly. Yes, we believe the Fed will begin an easing cycle and bonds should rally, yet equity investments should outperform fixed income in that environment. Specifically, among equities, we favor investments away from large cap growth, particularly US small cap and value-oriented sectors and companies. As mentioned above, we are encouraged by the recent move in small cap stocks and believe that momentum should continue into the new year. Over the long term, small cap companies have been a source of meaningful growth and outperformance for investors and current valuations of small relative to large are at 20-year lows. Easier credit conditions will definitively help smaller companies, particularly as the headwinds of last year’s regional bank crisis wear off.

Overall, international markets, while cheap relative to the US, remain less interesting to us as economic policies and momentum remain challenged. The much anticipated China “Re-Opening” proved to be a flop and the country continues to struggle with banking and real estate woes. There are always specific opportunities (see Argentina?!?) and dollar weakness could provide some benefit to international markets but overall, we find investment opportunities here in the US to be both more imminent and more transparent.

Consistent with our viewpoint of a broadening of equity returns here in the US, we believe that active management has a greater opportunity to add value. Over 70% of the companies making up the S&P 500 underperformed in 2023 creating a ripe opportunity for stock pickers and other active investors. As such, we will overweight alternatives and other active approaches in both equity and fixed income.

Our viewpoint is constructive. Yet risks always remain, particularly relative to consensus. For example, the market’s optimism around the Fed could ultimately be a risk source if inflation somehow perks up and the Fed reverts to a “higher for longer” monetary policy stance. Right now, that seems like an unlikely scenario, but it is a risk, nonetheless. Additionally, it is a presidential election year featuring two octogenarians in Joe Biden and Donald Trump. Theatrics and hyperbole will ensue, but will it create market volatility? Historically, markets are often weak in the first quarter and then rally throughout the election season. Currently, prediction markets are roughly split between Trump and Biden and much will change over the next several months. Yet the real risk centers on policy as the Trump tax cuts are set to expire in two years and a continuation of Bidenomics would likely sunset those cuts permanently. The market is not currently focused on this issue, but it will become more paramount as the election season progresses and could be a meaningful market risk.

Lastly, Wall Street strategists, after missing the 2023 rally are now becoming more optimistic but not outright bullish. According to FactSet the median year end strategist forecast for the S&P 500 is just under 5100, implying roughly a 6% return for the year. Not entirely aggressive but quite plausible, particularly if we see a rotation from large cap growth and the M7 into other areas of the market. We do believe investors will be compensated for taking risk in 2024 but the source of that compensation is likely to be very different than the recent past.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments